Gothams LLC circulated a November draft proposing a Gaza Support System (GSS) that would levy fees per truck and for warehousing while seeking a minimum 300% return and seven years of exclusivity. A January slide deck pitched 46%–175% first‑year returns to sovereign investors. Experts called the terms unprecedented and excessive, and the State Department says no formal procurement process exists.

US Firm Proposed Gaza Logistics Monopoly With 300% Returns, Draft Shows

A November draft from disaster-response firm Gothams LLC sent to White House officials outlines a proposed Gaza Support System (GSS) that would charge per truck and for warehousing and distribution — and that seeks a minimum three-times (300%) return on capital plus a seven-year exclusive contract, documents obtained by the Guardian show.

The draft, printed on Gothams letterhead, describes a “fully integrated humanitarian logistics system” designed to move reconstruction materials into Gaza. It states the "Customer" (identified as the Board of Peace) "agrees to a minimum three (3) times return on capital expenditure" and requests "exclusivity to the Contractor for seven (7) years with a three (3) year subsequent option period."

Who Is Involved

Gothams’ CEO, Matthew Michelsen, told the Guardian in December he was withdrawing his bid, but records show a company partner remains involved. Chris Vanek, a Gothams partner and former U.S. Army officer, has recently been coordinating with White House officials about GSS, according to sources and documents reviewed by the Guardian. Gothams provided a statement from Vanek saying he offered unpaid planning assistance based on his experience in conflict zones and that he had not discussed financing or returns.

Funding Pitch and Investor Interest

Separately, a January 2026 slide deck circulated by GSS promoters projects returns of 46%–175% to "sovereign investors" in the first year. Sources say Board of Peace and White House officials have been exploring investments from sovereign wealth funds — naming the UAE’s Mubadala as an example — to help finance reconstruction elements such as the GSS.

Expert Reaction and Context

"There's never been a US government contract that had triple returns on capital, not in 200 years. To make 25% is considered good... This looks like highway robbery," said Charles Tiefer, an expert on federal contracting law who served on the Commission on Wartime Contracting in Iraq and Afghanistan.

Gothams, based in Austin, has worked on past government contracts, including support for a South Florida migrant tent camp known as "Alligator Alcatraz," which drew criticism over human rights concerns.

Why It Matters

The United Nations estimates Gaza’s reconstruction needs exceed $70 billion, saying roughly 75% of buildings were reduced to rubble and about 90% of residents were displaced. Any large-scale rebuilding depends on moving massive amounts of materials into Gaza — a process tightly controlled by Israel, which restricts items such as cement and generators.

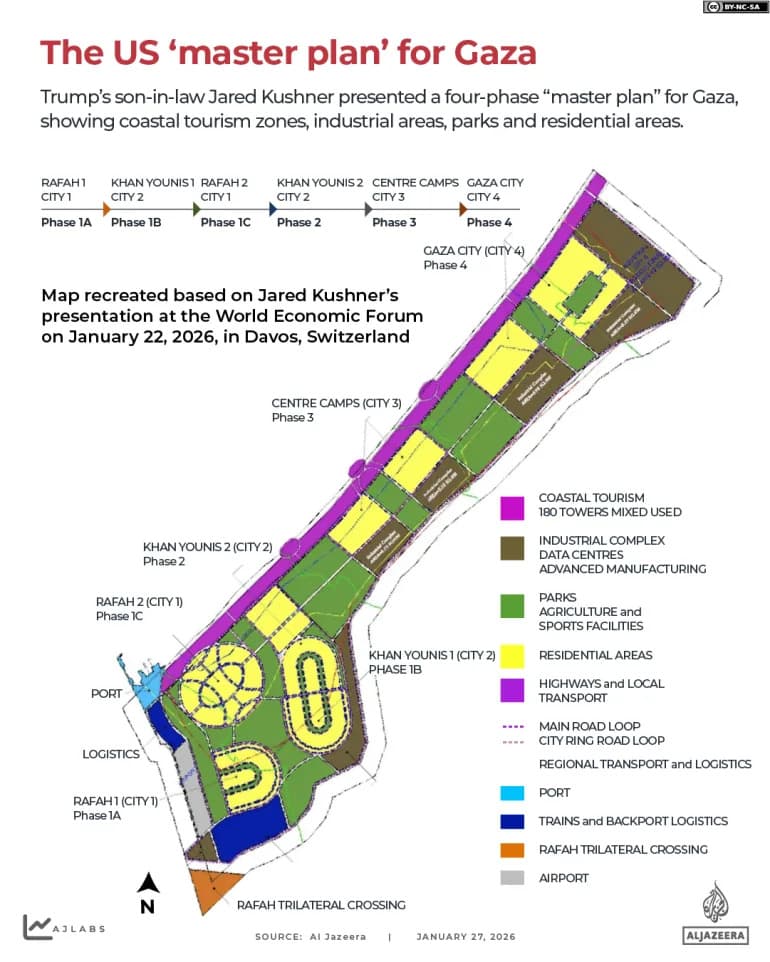

Donald Trump, who has called Gaza’s future potential the "Riviera of the Middle East," serves as chair of the Board of Peace. In January he named Jared Kushner and other allies to the Board’s executive team; Kushner later promoted investment opportunities tied to Gaza reconstruction at Davos but did not provide contracting specifics.

Official Response

The White House referred detailed questions to a State Department Gaza taskforce. State Department spokesperson Eddie Vasquez told the Guardian that "no procurement process or contracting mechanism has been stood up as the Board of Peace was just recently formed and announced" and that while informal conversations may have occurred, "all this remains TBD."

The draft proposal and the slide deck have prompted scrutiny because their proposed returns and exclusivity terms are unprecedented in the context of U.S. government contracting and humanitarian logistics.

Help us improve.