China’s defence manufacturing sector contracted by 10% last year, according to SIPRI, even as global arms revenues reached a record $679 billion. Analysts link the decline to President Xi Jinping’s anti‑corruption purge, which has removed senior military figures and defence executives and led to postponed contracts. Major firms including Norinco and CASC reported steep revenue falls — 31% and 16% respectively — raising concerns about delays to missile, satellite and cyber programmes. The disruption could complicate Beijing’s plans on Taiwan and in the South China Sea.

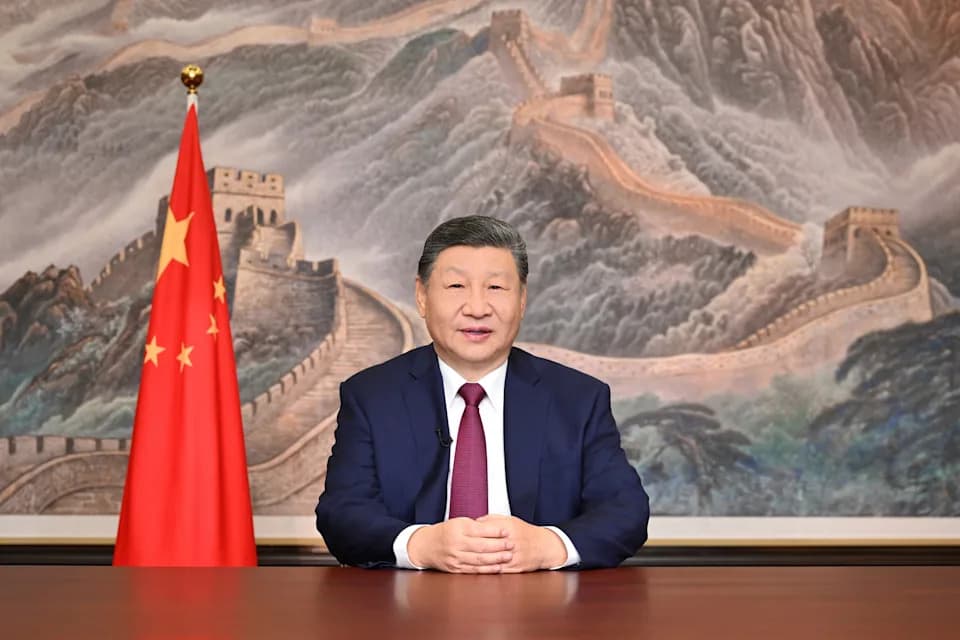

China’s defence industry shrinks 10% as Xi’s anti‑corruption purge stalls arms projects

China’s defence-manufacturing sector contracted sharply last year, with a 10% drop in revenue that analysts say is linked to President Xi Jinping’s wide‑ranging anti‑corruption campaign. The decline comes as global arms revenues hit a record, underscoring how internal political disruptions can slow defence procurement and development even as regional tensions rise.

SIPRI findings and global context

According to a Stockholm International Peace Research Institute (SIPRI) report, the revenues of the world’s 100 largest arms companies rose by 5.9% to a record $679 billion, but China’s defence sector bucked the trend. Asia‑Oceania was the only region to see a fall in revenues among top arms firms, driven largely by contractions at several major Chinese state groups.

Japanese firms led gains (up 40%), followed by Germany (36%) and South Korea (31%). The United States and the United Kingdom recorded more modest increases of 4% and 7% respectively.

Anti‑corruption purges and corporate fallout

Analysts link the downturn in China to a string of high‑level dismissals and corruption probes that delayed or cancelled major defence contracts. Dr Nan Tian, director of SIPRI’s military expenditure and arms production programme, said:

“A host of corruption allegations in Chinese arms procurement led to major arms contracts being postponed or cancelled in 2024. This deepens uncertainty around the status of China’s military modernisation efforts and when new capabilities will materialise.”

High‑profile removals have included senior military officials and executives at leading defence groups. Notable cases cited in the SIPRI analysis include Liu Shiquan, former chair of China North Industries Corporation (Norinco), whose dismissal preceded a 31% revenue fall at Norinco — the largest decline among Chinese firms in SIPRI’s ranking.

Other affected firms include China Aerospace Science and Technology Corporation (CASC), which reported a 16% drop attributed largely to postponed satellite and launch‑vehicle projects after leadership changes, and the China Electronics Technology Group Corporation (CETC), which fell by about 10%.

Implications for capabilities and regional security

The revenue declines raise questions about the timeline for several advanced programmes that Xi has prioritised. SIPRI researcher Xiao Liang warned that projects involving the People’s Liberation Army Rocket Force — responsible for ballistic, hypersonic and cruise missiles — as well as aerospace and cyber initiatives, could face delays or uncertain delivery schedules.

Those setbacks arrive against a backdrop of increasing regional militarisation. Tokyo has signalled a more assertive posture amid rising tensions with Beijing, and the uncertainty around China’s procurement and production timelines could influence strategic calculations across East Asia, especially regarding Taiwan and the South China Sea.

Conclusion

While China remains a major military power and maintains the largest standing army in the world, recent corporate revenue declines and postponed programmes suggest that internal political dynamics — notably Xi’s anti‑corruption campaign — have produced tangible setbacks in parts of the defence industrial base. How long these effects persist will be a key determinant of Beijing’s near‑term ability to field some advanced capabilities.

Help us improve.