Western leaders from Britain, Canada and other European countries have recently visited Beijing amid strains with the United States under President Donald Trump. Those visits produced concrete deals — notably on electric vehicles and trade access — and are being framed in China as evidence that broad economic decoupling is losing steam. European governments nonetheless continue to guard against security, human-rights and trade risks, pursuing both engagement and defensive measures. The overall trend is pragmatic hedging rather than a clean break from Washington.

Western Leaders Stream to Beijing — China Seizes Momentum as Global Order Shifts

As tensions between the United States and several Western capitals have grown under President Donald Trump’s volatile foreign policy, Beijing has seized an opening: a steady procession of Western leaders traveling to China to reset or deepen ties.

Diplomatic Visits and Concrete Deals

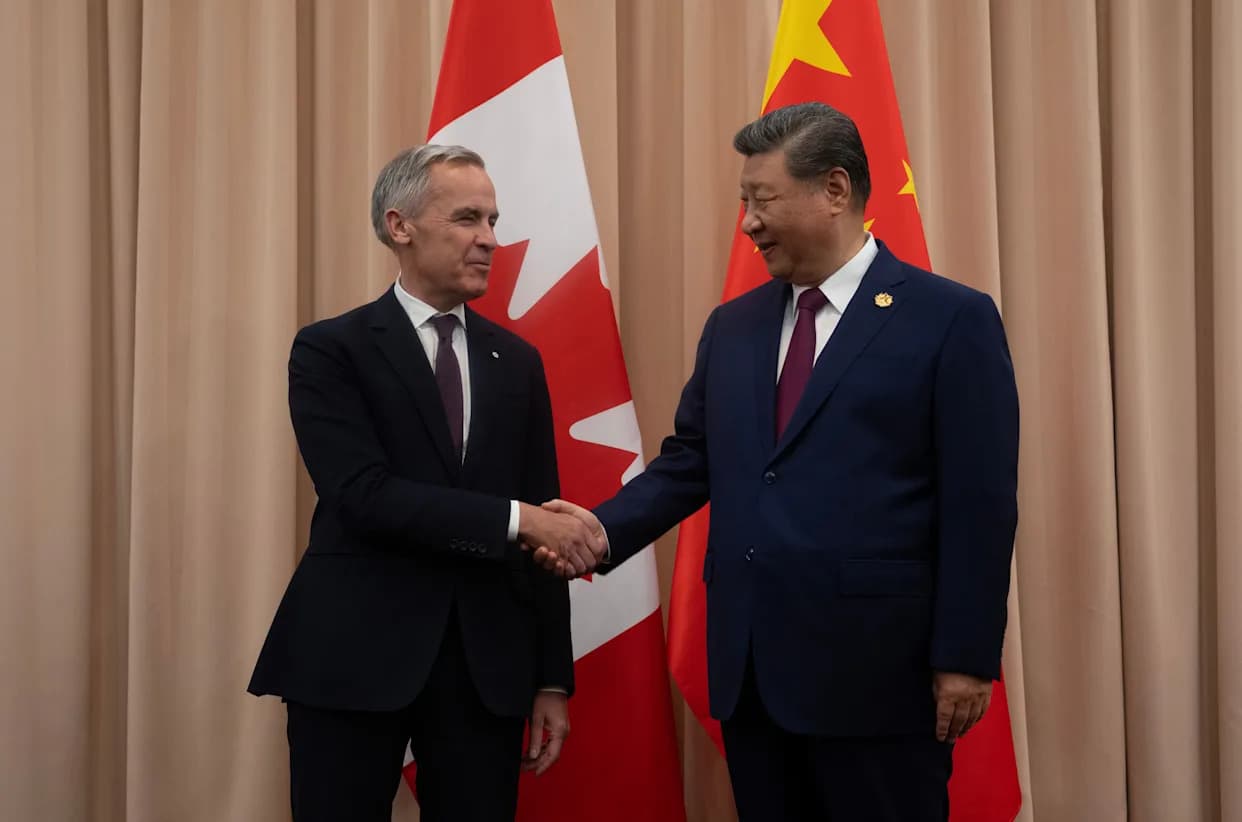

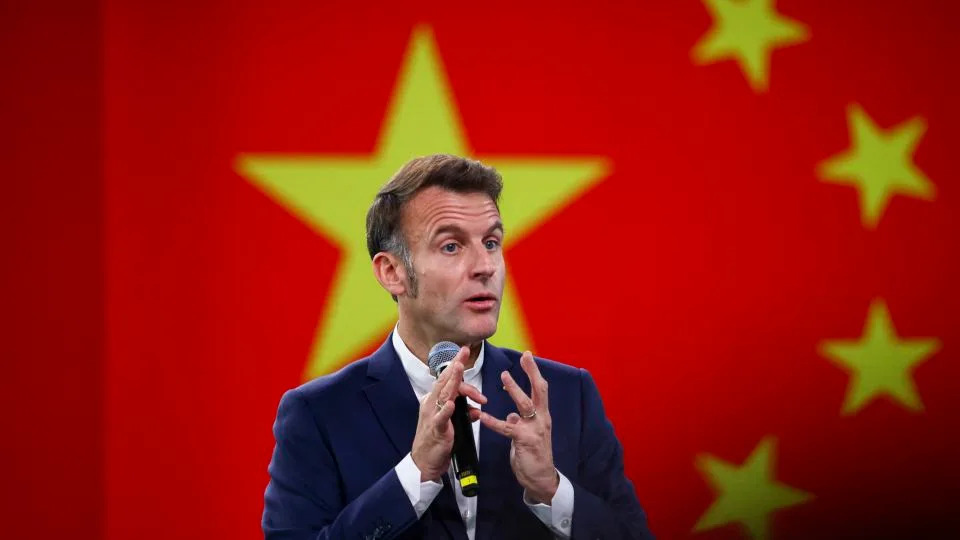

In recent weeks Xi Jinping has hosted a string of prominent visitors, including Britain’s Keir Starmer, Canada’s Mark Carney, Finland’s Petteri Orpo and France’s Emmanuel Macron, with German Chancellor Friedrich Merz expected to visit soon. From Beijing’s perspective, the visits signal that momentum toward economic decoupling is softening and that many Western governments are pursuing a more pragmatic engagement with China.

Those trips have already produced tangible outcomes: Canada eased tariffs on China-made electric vehicles in exchange for fewer barriers on agricultural exports, while China and the European Union agreed to replace punitive tariffs with minimum-price commitments on Chinese EVs to protect European automakers. Leaders have publicly framed closer ties as important to international stability and their national interests.

Balancing Engagement With Persistent Concerns

European capitals remain wary of long-term risks. Governments have tightened scrutiny of Chinese roles in telecoms, critical infrastructure and higher education, and restricted sales of advanced semiconductor technologies on national-security grounds. The EU continues to describe China as an “economic competitor and a systemic rival,” while also proposing new rules to phase out components from “high-risk” suppliers and strengthening investment screening.

“Mistrust of China remains deep… but European states cannot ignore China, particularly when the US is perceived as going ‘rogue,’” said Steve Tsang, director of the SOAS China Institute.

At the same time, leaders such as Starmer and other European figures argue that economic engagement need not come at the expense of security safeguards. Brussels is still pursuing measures to reduce dependence on Chinese critical minerals and tackle the large trade surplus.

How Beijing Frames the Shift

Chinese analysts and state media present the diplomatic round of visits as evidence that the idea of broad decoupling is impractical and unpopular. Some commentators argue that U.S. moves — including stepped-up rhetoric, occasional withdrawal from international bodies, and intermittent tariff threats — are prompting Europe to hedge and to consider China as a necessary counterweight in a changing multilateral system.

Beijing emphasizes the benefits of closer economic ties and portrays the warming relations as validation of its market appeal and its vision for a multipolar world where states prioritize pragmatic economic and strategic calculations over ideological blocs.

Outlook

While the recent diplomacy offers Beijing opportunities to advance its technological and trade ambitions with less friction, Western governments are continuing to weigh those benefits against concerns about human rights, security and unfair trade practices. The emerging pattern is one of pragmatic hedging: engagement where it serves national interests, while preserving defensive measures where risks remain.

Bottom line: High-level visits to Beijing have produced concrete trade and diplomatic outcomes, but they have not erased deep strategic and political concerns. The result is a more complex and pragmatic European approach toward China rather than a wholesale pivot away from the United States.

Help us improve.