At Davos, President Trump renewed his push to acquire Greenland and warned of 100% tariffs on resisting Europeans, then abruptly backtracked after allied leaders coordinated a response. European officials, galvanized by Mark Carney’s speech, threatened to use the EU’s Anti-Coercion Instrument — the so-called "Bazooka" — and markets briefly tumbled (S&P 500 fell ~2.5%). The episode exposed a widening credibility problem for the U.S. under Trump and signaled Europe’s growing interest in alternatives as China and other partners expand influence.

How Europe’s Stand at Davos Exposed Trump’s Weakness — And Raised Questions About U.S. Credibility

It is striking how often Donald Trump repeats the same confrontational performance and still manages to surprise observers who, it seems, have never seen it before. That pattern played out again at the World Economic Forum in Davos, Switzerland.

In a combative address on Wednesday, the president renewed his strange fixation on Greenland, insisting the United States should control the island for national-security reasons and delivering a threatening line to European leaders: “You can say yes and we will be very appreciative, or you can say no and we will remember.” A few days earlier he had warned he might impose 100 percent tariffs on European countries that resisted a U.S. takeover. For a moment it looked as if he might try to follow through.

Then, unexpectedly, he reversed course. Only hours after the speech, Trump emerged from a meeting with Dutch Prime Minister Mark Rutte and announced they had the “framework of a future deal” over Greenland, eliminating any need for an invasion or immediate punitive tariffs. Asked for details, he deferred: “We’ll have something in two weeks.”

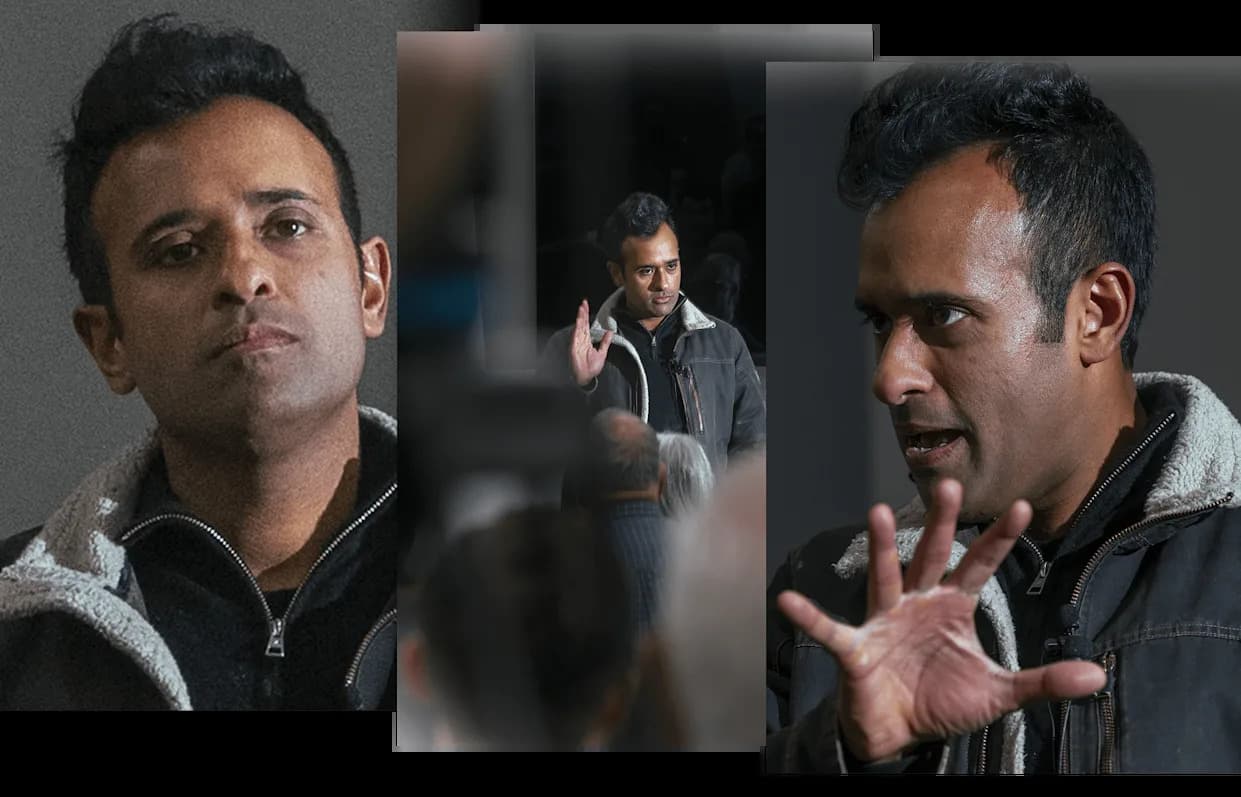

Why the sudden retreat mattered. The episode was different from earlier tariff-scare episodes because the targets of the threats — European leaders — were in the same room when he made them. They had convened beforehand to coordinate a unified response, and they were energized by a rousing address from Mark Carney, the former governor of both the Bank of Canada and the Bank of England, who argued that medium-sized countries acting together can blunt the coercive tactics of larger powers.

The Europeans did what Trump apparently expected they would not: they stood firm.

European officials threatened to invoke the EU’s Anti-Coercion Instrument — colloquially called “the Bazooka” — which empowers the bloc to retaliate against economic coercion with tariffs and penalties. That deterrent, together with nervous market reactions (the S&P 500 slid about 2.5 percent before recovering), appears to have helped persuade the president to step back.

Many European leaders — and likely some U.S. aides — breathed a collective sigh of relief. Despite talk of “strategic autonomy” in some quarters, most EU members still value productive relations with the United States: the dollar dominates global transactions, and a dependable U.S. military presence remains central to Europe’s security for the foreseeable future.

Still, Trump’s abrupt turnabout in Davos highlighted a deeper problem. He arrived striking an aggressively belligerent tone and then, within hours, reversed without explanation and with only a vague promise of future talks. That pattern erodes the credibility of U.S. commitments: the president remains commander in chief of the world’s most powerful military, but allies and partners increasingly wonder whether his threats or promises can be taken at face value.

The summit crystallized this shift in two ways. First, the speech itself was unusually hostile, and the subsequent retreat unusually capricious — hardly evidence of some strategic master plan. Second, leading allies publicly discussed his conduct and embraced arguments like Carney’s, which offer a path toward more coordinated, independent action when Washington’s policies threaten to coerce them.

Geopolitically, the landscape is changing. China is quick to move into markets that open as trans-Atlantic ties fray, and the EU has pursued trade relationships with other regions that reduce U.S. leverage. Even symbolic moves matter: Denmark said it would sell about $100 million in U.S. Treasury notes at month’s end — a small sum in the context of the EU’s roughly $10 trillion in U.S. assets, but a notable, emblematic gesture.

Trump responded to mounting transatlantic frustration with contempt in Davos, claiming that without the United States much of the world “wouldn’t be making anything,” asserting that “you wouldn’t have NATO” without his efforts, and adding that if the U.S. had not entered World War II “you’d all be speaking German” — an awkward remark to make in a Swiss forum where German is widely spoken.

Yes, the United States retains significant leverage. But Davos underscored that the rules of global engagement are shifting. Even powerful cards can lose value if other players coordinate, diversify partnerships, and erect credible countermeasures. The question for Washington and its allies is whether they will repair mutual trust and rebuild predictable ties — or watch influence dissipate as others fill the void.

Help us improve.