World Inequality Report 2026: The richest 10% now own about 75% of global personal wealth and received 53% of global income in 2025. The top 0.001% hold three times more wealth than the bottom half of humanity. Regional and national patterns vary widely: North America and Oceania lead average wealth, while South Africa and several Latin American countries show the most extreme inequality. Even many advanced economies display substantial disparities, leaving the bottom half with a small share of assets and earnings.

Global Inequality: The Top 10% Now Hold Three-Quarters of World Wealth

The newly released World Inequality Report 2026 finds that wealth and income are concentrated at historically high levels: the richest 10% of the global population now own roughly three-quarters of all personal wealth, while the top half of earners receives more than 90% of global income.

Key Findings

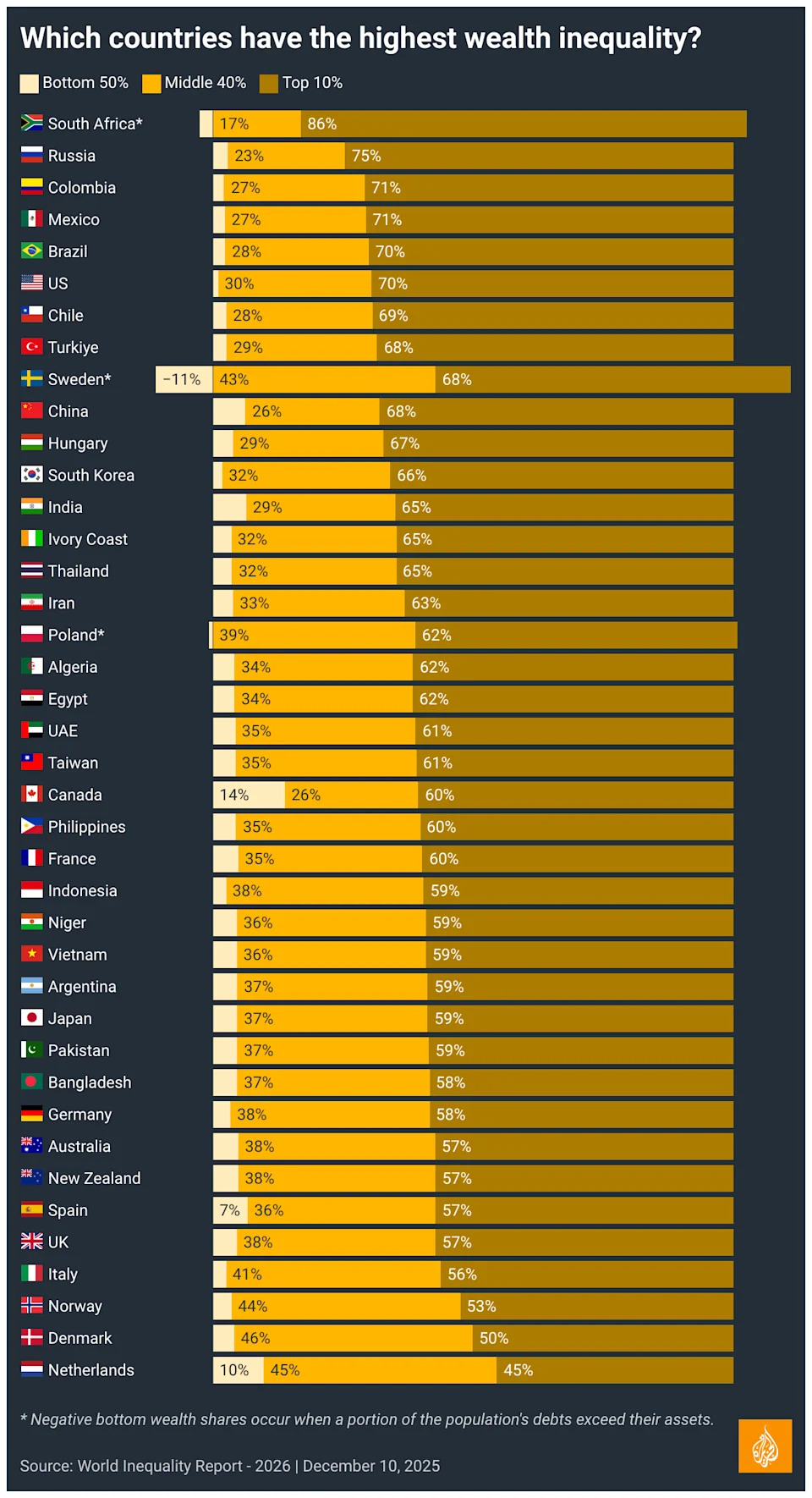

Wealth: Wealth is defined as the net value of a person’s assets — savings, investments or property — after subtracting debts. By 2025, the richest 10% owned about 75% of global personal wealth, the middle 40% held 23%, and the bottom 50% controlled only 2%.

Since the 1990s the fortunes of billionaires and centi‑millionaires have grown at about 8% per year, nearly double the rate experienced by the bottom half of the world’s population. The very top 0.001% — fewer than 60,000 multimillionaires — now possess three times more wealth than the poorest half of humanity, with their share rising from roughly 4% in 1995 to over 6% today.

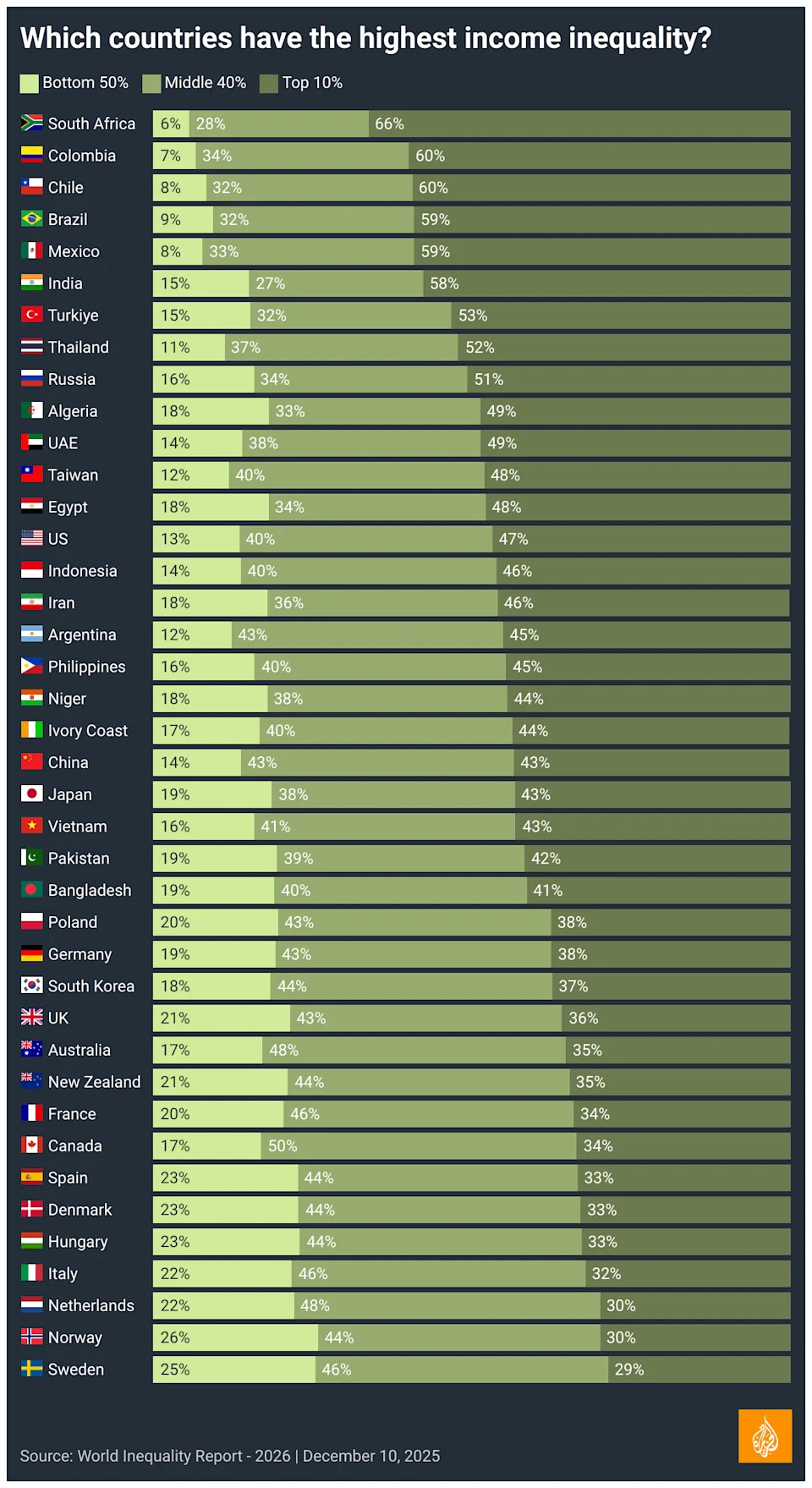

Income: Income in the report is measured as pre‑tax earnings after accounting for pension and unemployment insurance contributions. In 2025 the distribution was also heavily skewed: the richest 10% received 53% of global income, the middle 40% took 38%, and the bottom 50% earned only 8%.

To put that into simple terms: if the world were 10 people sharing $100 of income, the richest person would get $53, the next four would share $38, and the remaining five would split $8.

Regional And Country Patterns

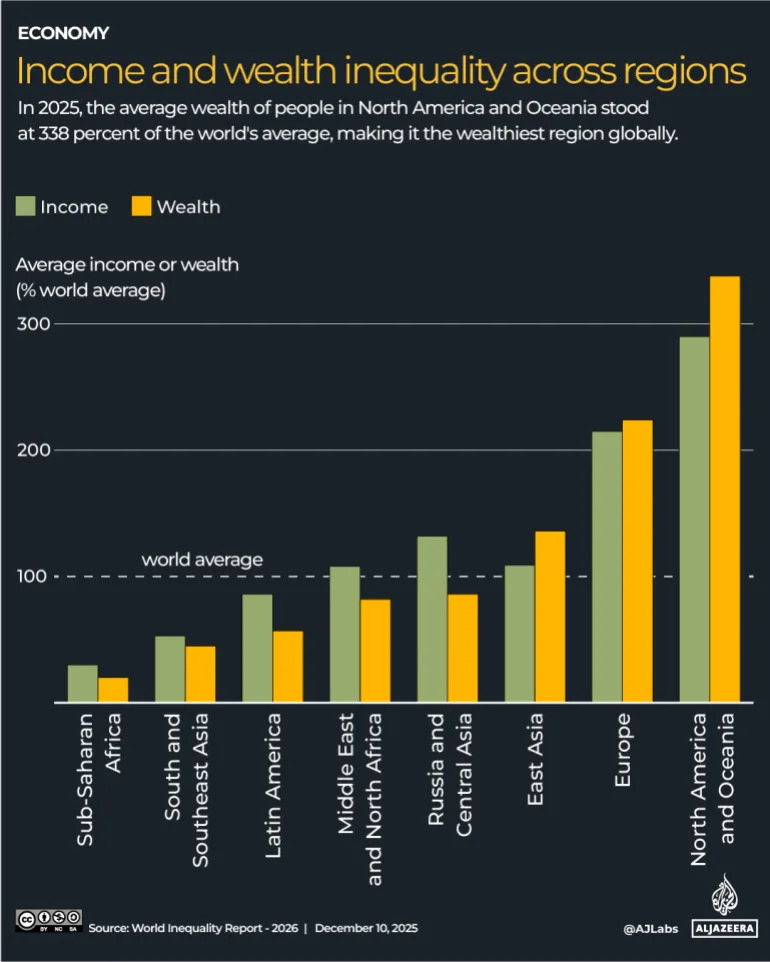

A person’s birthplace remains one of the strongest predictors of their income and wealth. In 2025 North America and Oceania (grouped together in the report) had the highest average wealth — about 338% of the world average — and the largest income share at roughly 290% of the global mean. Europe and East Asia were above the world average, while large parts of sub‑Saharan Africa, South Asia, Latin America and the Middle East remained well below it.

Country-level differences are stark. South Africa shows the most extreme inequality: the top 10% earn 66% of national income and control about 85% of personal wealth, while the bottom 50% have negative net wealth (their debts exceed assets). Several Latin American countries (Brazil, Mexico, Chile, Colombia) also show very high concentration, with the top decile taking nearly 60% of income and 70%+ of wealth in some cases.

By contrast, some European countries present a more balanced distribution: in Sweden and Norway the bottom 50% receive about 25% of income and the top 10% less than 30%. Many advanced economies (Australia, Canada, Germany, Japan, the United Kingdom) fall in the middle range, where the top 10% earn roughly 33–47% of income and the bottom half receives 16–21%.

Emerging Asian economies are mixed. China and Bangladesh show relatively more even income patterns than many peers, while India, Thailand and Türkiye remain skewed toward the top. Across several Asian countries, the richest 10% control roughly 65–68% of wealth.

Implications

Although the poorest cohorts have seen modest gains over recent decades, those improvements are far outpaced by rapid accumulation at the top. The report underscores growing gaps in financial power and economic security: a tiny minority holds extraordinary resources while billions still struggle to secure basic living standards. These trends raise important questions about taxation, public policy, and the future distribution of economic opportunity worldwide.

Help us improve.