Small EU members such as Cyprus have rapidly expanded domestic defense industries, producing aerial and marine drones now used on the Ukrainian front and exported worldwide. Cypriot firm Swarmly reports 200+ H-10 Poseidon drones logged more than 100,000 flight hours across three years, while its Hydra marine drone costs about €80,000 each. EU funding programs like SAFE and NATO encouragement are accelerating investment, though experts warn UAV effectiveness depends on conditions, operator skill and logistical support.

Tiny Countries, Big Drones: How Small EU States Like Cyprus Are Powering Ukraine’s UAV Edge

NICOSIA, Cyprus — On the southeastern edge of Europe, a nation of just over a million people has become an unexpected exporter of combat drones now heard over Ukrainian battlefields.

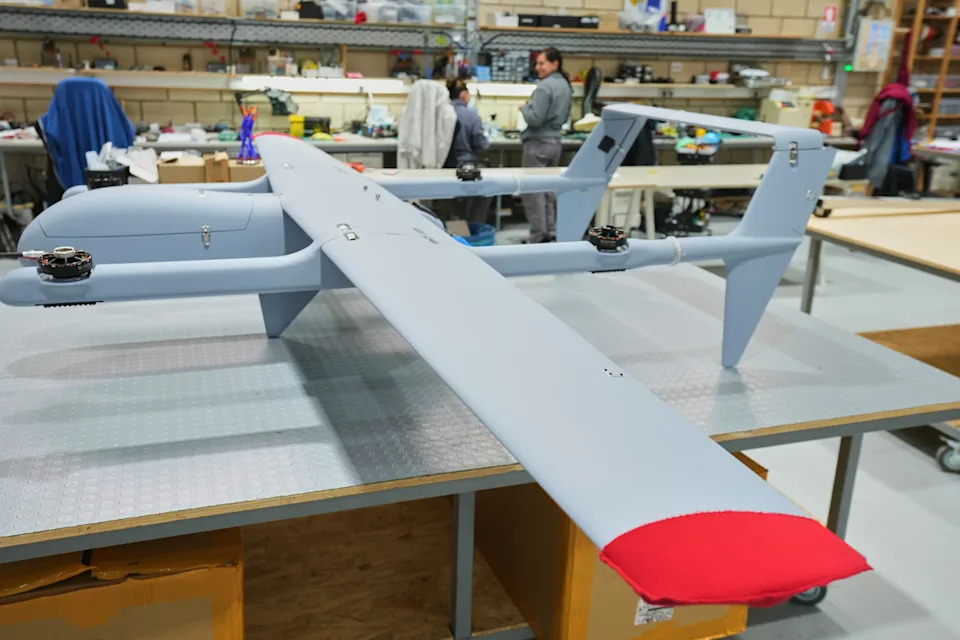

Swarmly, a Cypriot manufacturer, says more than 200 of its H-10 Poseidon drones have supported Ukrainian artillery units by helping to locate enemy positions in all weather conditions, accumulating more than 100,000 flight hours over the past three years. The company’s 5,000-square-meter (54,000-square-foot) factory hums with activity as grinders shape composite plastics and technicians assemble unmanned systems for export to destinations that include Indonesia, Benin, Nigeria, India and Saudi Arabia.

While most of the facility focuses on aerial drones, a secure area houses fast marine drones fitted with high-definition cameras and heavy machine-gun mounts. The growth of firms such as Swarmly illustrates a broader trend: Russia’s invasion of Ukraine has accelerated the development of domestic defense industries across even Europe’s smallest EU members, and Kyiv’s experience has made Ukraine a hub of advanced UAV technology and battlefield testing.

Force Multipliers

Uncrewed aerial vehicles (UAVs) are reshaping modern warfare by giving smaller or less well-resourced states new forms of leverage against larger opponents. They are not a wholesale substitute for tanks, artillery or manned aircraft, but they offer flexibility, affordability and a rapid way to scale capabilities.

Swarmly’s Hydra marine drone, a satellite-guided explosive platform, costs about €80,000 (roughly $95,000) apiece, according to company officials. That price point makes it feasible to deploy swarms of smaller craft against far more expensive naval targets — a tactic reflected in recent attacks on commercial and military shipping in the Red Sea and Gulf of Aden.

“Many uncrewed systems can be designed and put together without decades-long industrial investment,” said Fabian Hinz, a research fellow on missile technologies and UAVs at the International Institute for Strategic Studies (IISS), noting that many components are commercially available.

Getting In The Game

Across Europe, countries both large and small are expanding drone and counter-drone capabilities. Denmark’s anti-drone firms report rising demand and new contracts, some directed to Ukraine to help jam Russian systems on the battlefield. In September, Ukrainian authorities announced partnerships with Danish companies to produce missile and drone components in Denmark.

In the Baltics, Lithuania’s universities, research centers and private firms — grouped around initiatives such as VILNIUS TECH — are developing UAVs, automated mine-detection systems and other technologies. The state-run ammunition plant Giraite says it has increased output by roughly 50% since 2022. Greece has incorporated unmanned systems into a wide-ranging €25 billion modernization program and showcased homegrown drones and counter-drone technologies during a tactical exercise in November.

European and NATO leaders have urged rapid innovation and field testing. During visits to the region, Dutch Prime Minister Mark Rutte and other officials emphasized the need for capabilities, equipment and advanced technology to strengthen deterrence.

Still, experts caution that UAV effectiveness depends on many variables: harsh operating environments, operator training and the logistical depth required to sustain prolonged operations can all blunt their battlefield advantage.

Europe Moves To Bolster Defense

Russia’s war in Ukraine, alongside concerns about transatlantic policy uncertainty in recent years, has prompted the EU to push for greater defense self-reliance. The bloc has mobilized billions of euros of support and procurement initiatives to stimulate investment and increase collective deterrence.

Cyprus, which assumed the EU presidency for six months on Jan. 1, is poised to receive around €1.2 billion ($1.4 billion) in low-interest, long-term loans under the EU’s Security Action for Europe (SAFE) joint procurement program, part of a broader €150 billion initiative. Cyprus’s nascent defense sector now includes roughly 30 companies and research centers producing dual-use and military technologies — from robotics and communications networks to anti-drone systems and satellite communications — according to Panayiotis Hadjipavlis, head of armaments and defense capabilities development at Cyprus’s Defense Ministry.

“We have niche capabilities on very high-tech products and this has to be taken seriously into account,” Hadjipavlis told The Associated Press, noting that larger defense firms and partners should pay attention to the island’s growing expertise.

As small EU states scale up production and innovation, the flow of new unmanned systems into active conflict zones — and into global export markets — underscores how quickly the balance of military technology can shift when innovation, funding and battlefield demand converge.

____

Associated Press writer Liudas Dapkus in Vilnius, Lithuania contributed to this report.

Help us improve.