The Bureau of Labor Statistics will not publish an October CPI report after a 43-day government shutdown halted price and household data collection. That cancellation—along with a postponed October jobs report—leaves the Federal Reserve without fresh federal employment or inflation figures ahead of its Dec. 9–10 meeting. Fed officials remain divided on whether to cut rates again, while political pressure on Fed leadership has intensified.

BLS Cancels October CPI Report After 43-Day Shutdown, Complicating Fed's December Decision

The Bureau of Labor Statistics (BLS) announced it will not produce its October consumer price index (CPI) report after a 43-day government shutdown prevented the agency from collecting essential price and household data. Because the information that would have been gathered during the funding lapse cannot be obtained retroactively, the agency said an October CPI update is not possible.

Why the report was canceled

Nearly all BLS staff were furloughed during the shutdown, which ran from Oct. 1 to Nov. 12, leaving the agency unable to conduct in-person price and household surveys. BLS also canceled the October employment report for the same reason. As a result, two of the Federal Reserve’s major federal data inputs—recent CPI and employment figures—will be missing heading into the Fed’s final policy meeting of the year.

Implications for the Federal Reserve

The Federal Open Market Committee (FOMC) will meet Dec. 9–10 without fresh, major federal employment or inflation data from BLS to inform its decision. While the Fed can draw on private-sector indicators and the BLS’s Employment Cost Index (ECI) for compensation trends, the absence of up-to-date CPI and jobs reports could complicate deliberations over whether to cut rates again or hold steady.

Fed officials are split. Some view the recent uptick in inflation as a temporary adjustment tied to tariffs and other one-off factors and favor resuming cuts, while others worry that lowering rates without clearer evidence that prices will stabilize could be risky. The FOMC trimmed rates in September and October after a series of weak jobs reports, and overall employment growth has been muted since April. Still, headline inflation measured by the CPI rose back to about 3% in September, matching its January level.

Political fallout and leadership questions

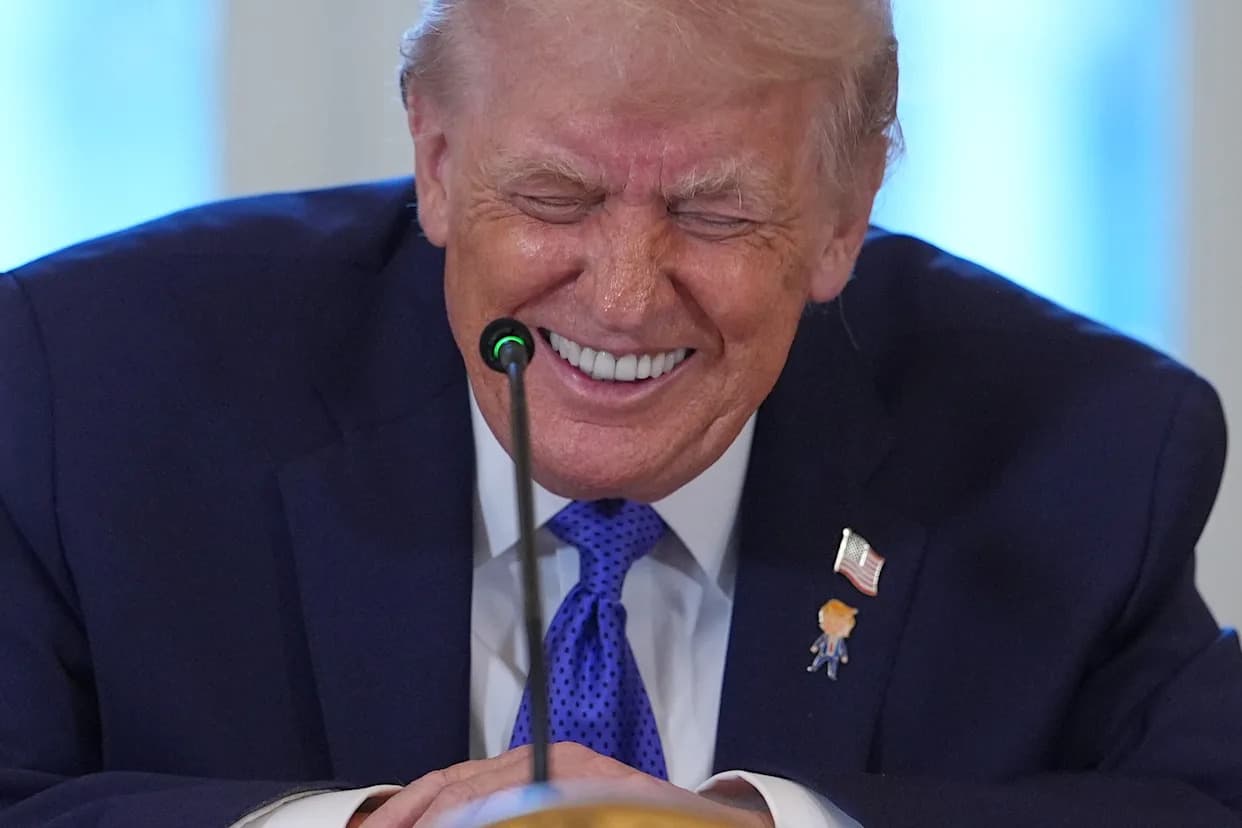

Political tensions have added pressure to the Fed’s decision-making environment. President Trump intensified criticism of Fed Chair Jerome Powell this week and said he would have removed Powell if not for the intervention of Treasury Secretary Scott Bessent, who reportedly declined Trump’s offer to take the Fed job. By law, the Fed chair can only be removed “for cause,” a standard courts generally interpret as severe misconduct rather than policy disagreements. Powell’s term as Fed chair expires in May, and the president is expected to announce a nominee; Vice Chair Michelle Bowman and board member Christopher Waller have been mentioned as potential finalists.

Next steps and timing

BLS delayed the November CPI and jobs releases—originally scheduled for Dec. 5 and Dec. 10—until after the Fed meeting because of the shutdown. The agency did release the September jobs report after the government reopened. Market participants and policymakers will therefore rely on a mix of private data, the ECI, and older federal reports until BLS resumes its regular publication schedule.

Bottom line: The shutdown-created data gap removes two key, timely federal inputs for the Fed’s December meeting, increasing uncertainty around the path of interest rates and elevating the importance of alternative indicators.

Help us improve.