TrumpRx — a direct-to-consumer drug portal backed by the Trump administration — is set to launch Thursday, promising discounted cash prices on selected medicines including obesity drugs such as Zepbound and Wegovy. Experts say the portal could help uninsured people and patients with high deductibles, but many insured patients may still pay less by using their plans. Key uncertainties include the full product list, final prices and whether cash payments will count toward insurance deductibles. The program’s broader market impact is expected to be limited and uneven.

TrumpRx Set to Launch — Will Direct Sales Actually Lower Drug Costs for Most Patients?

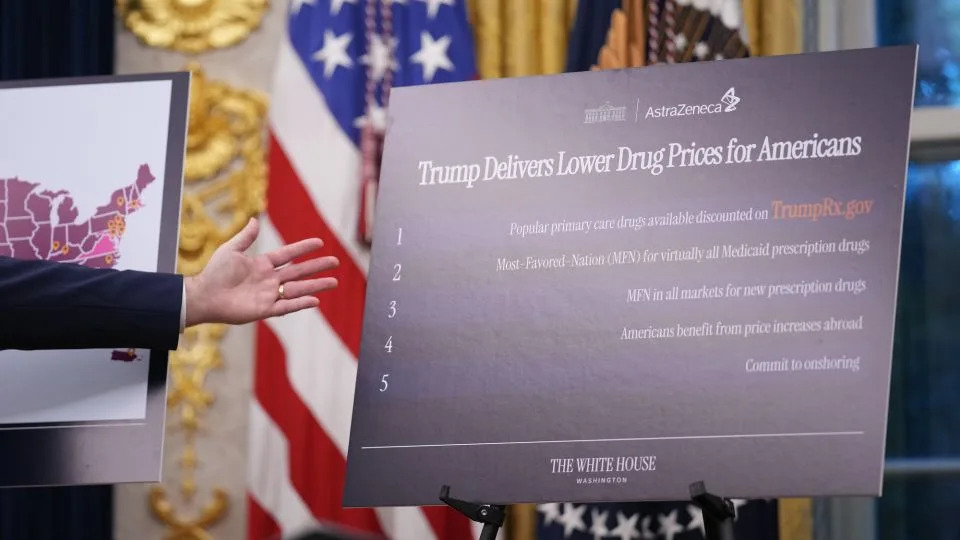

TrumpRx, the Trump administration’s long-awaited direct-to-consumer drug portal, is expected to go live on Thursday and will link patients directly with manufacturers offering selected medicines at discounted cash prices. The initiative aims to reduce out-of-pocket costs by cutting intermediaries, but experts say its benefits will likely be limited and depend heavily on patients’ insurance status, deductibles and the specific drugs offered.

What Is TrumpRx?

TrumpRx is a government-backed online clearinghouse that connects consumers to pharmaceutical manufacturers willing to sell certain medicines directly to cash-paying customers who opt out of using insurance. Announcements say at least 16 drugmakers have agreements to participate, and some headline offers include Eli Lilly’s Zepbound and Novo Nordisk’s Wegovy for as little as $149 per month, Amgen’s Repatha for $239 per month, and Merck’s Januvia for $100 per month.

Who Might Benefit?

Direct sales could help two groups most: uninsured patients and insured patients with high deductibles who would otherwise pay full price until their deductible is met. For drugs that insurers commonly don’t cover—such as many obesity medicines—manufacturer cash portals may make those treatments accessible to more people.

Key Unknowns and Caveats

- Deductible Accounting: A major question is whether insurers will allow cash payments made through TrumpRx to count toward patients’ deductibles and out-of-pocket maximums. If not, patients could pay substantial cash without progress toward their annual insurance protections.

- Prices vs. Real-World Costs: Advertised discounts are measured against list prices, which often differ from what insured patients actually pay after negotiated rebates and plan cost-sharing.

- Product Availability: Details remain limited about the full product list and long-term pricing.

Industry Context

Direct-to-consumer drug sales are not new. Mark Cuban’s Cost Plus Drug Company began selling generics directly in 2022. Eli Lilly operates LillyDirect and reported more than 1 million U.S. patients engaging with the platform in 2025; company executives said self-pay Zepbound vials account for roughly one-third of new patients starting any brand-name obesity drug. Novo Nordisk’s NovoCare accounts for about 30% of Wegovy prescriptions and roughly 90% of prescriptions for its new Wegovy pill.

Recent Developments

Express Scripts, a large pharmacy benefit manager owned by Cigna, reached a settlement with the Federal Trade Commission over allegations of artificially inflating insulin prices. Under terms reported alongside the settlement, Express Scripts agreed to count certain payments made through TrumpRx toward members’ deductibles and out-of-pocket maximums, subject to legislative or regulatory changes—an early sign that insurers and PBMs may adapt to direct-pay channels.

Why Experts Are Skeptical

“TrumpRx might support access and affordability for a very small number of people,” said Rena Conti, associate professor at Boston University’s Questrom School of Business.

Health policy researchers caution that for many insured patients, plan copays or coinsurance will be lower than cash prices on manufacturer portals once deductibles are met. Behavioral research also suggests price sensitivity: when monthly cost exceeds roughly $100, many patients stop filling prescriptions, which could limit the real-world impact of discounts that remain above that threshold.

Potential Unintended Consequences

Experts warn insurers could respond by narrowing coverage for drugs now available via direct channels, arguing those products no longer need to be included on formularies. The overall market effect may be uneven: deep cuts on select top-selling drugs could make headlines, while prices and access for many other medicines remain unchanged.

Bottom Line

TrumpRx could increase affordability for uninsured patients and those with high deductibles, and it may expand access to drugs not commonly covered by insurance—especially obesity treatments. However, for many insured patients, going through insurance will still often be cheaper over the course of a year. The platform’s ultimate impact will depend on the final product list, sustained pricing, and whether insurers count cash payments toward patients’ deductibles and out-of-pocket maximums.

Help us improve.