The latest CBS News/YouGov poll finds many Americans struggling with holiday expenses: a majority say buying holiday items is at least somewhat difficult and many plan to cut back on gifts, entertainment and travel. Those reporting good personal finances are less likely to pare back, though they also acknowledge rising prices. The survey also shows persistent economic divides through 2025, broad concern about inflation, a mixed jobs picture after stronger-than-expected November payrolls, and a recent shift toward falling local gas prices.

Most Americans Say Holiday Costs Are Rising; Many Plan To Scale Back, Poll Finds

Many Americans report feeling financial strain this holiday season as higher prices shape plans for gifts, entertainment and travel, according to a new CBS News/YouGov poll.

Holiday Spending and Behavior

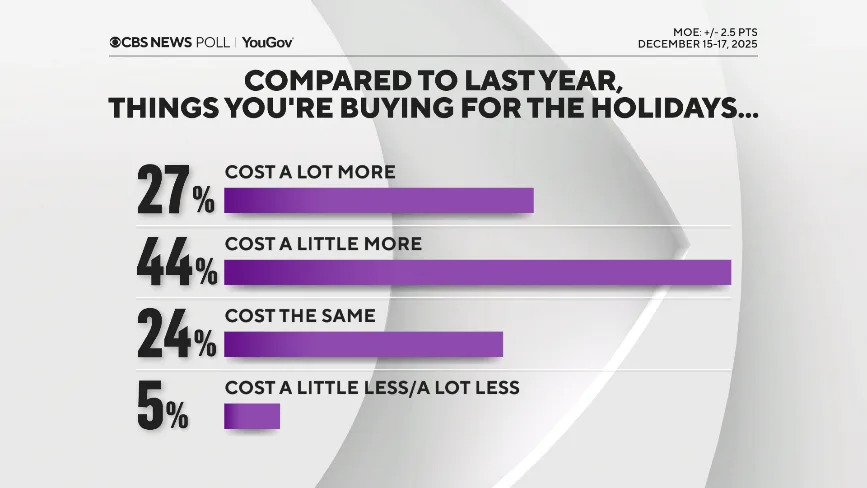

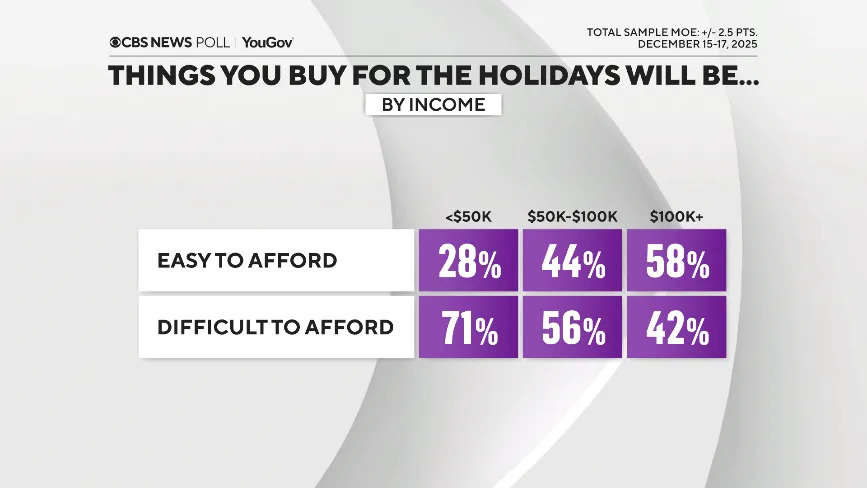

Most respondents say it is at least somewhat difficult to afford the items they plan to buy for the holidays, and a sizeable share say they are planning to cut back on gifts, outings and trips. Those reductions are especially common among the majority who say prices are higher now than a year ago.

Financial Divides

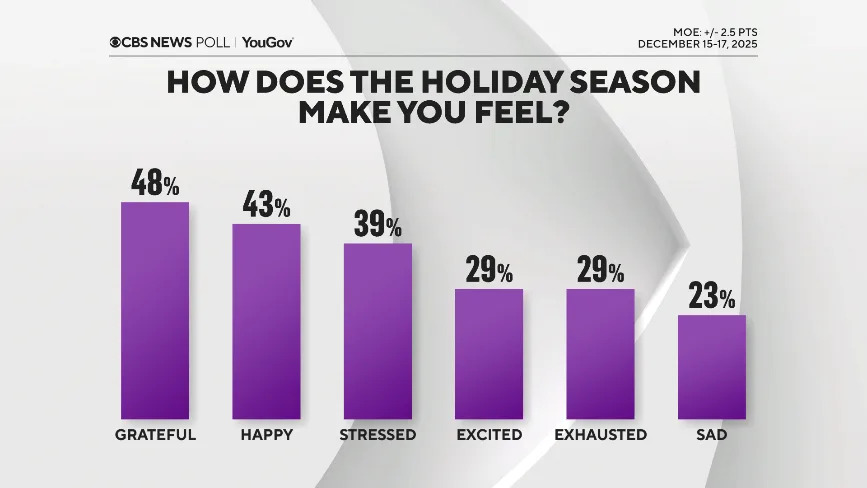

The survey highlights persistent disparities in household finances. People who describe their own financial situation as good — a group that tends to include higher-income households — are more likely to say holiday expenses are manageable, though many in that group still acknowledge rising prices. Conversely, respondents who say it is hard to afford holiday purchases are far more likely to report stress alongside feelings of gratitude or happiness.

Prices, Gas And Travel

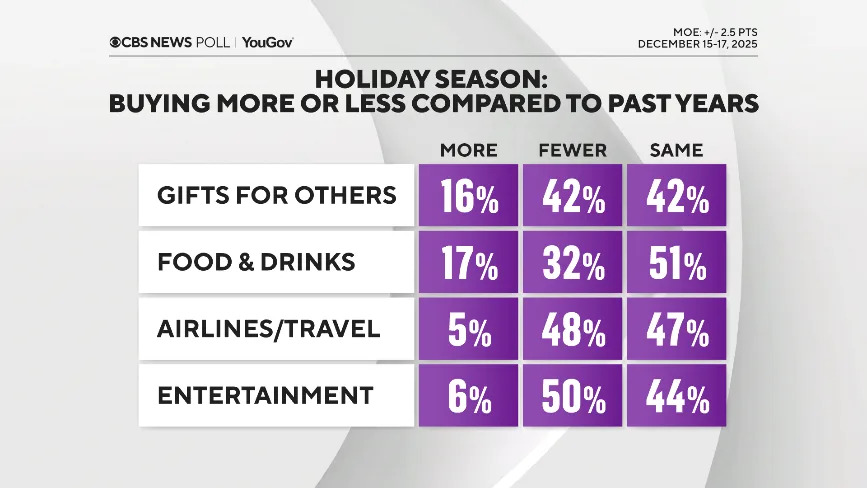

With holiday travel approaching, more respondents now report that local gas prices are falling than rising — the first time this balance has tipped toward declines this year. Compared with recent years, relatively few Americans say they plan to increase purchases of gifts, entertainment, airline tickets or food and drink for the holidays. Those who expect affordability to be a problem are particularly likely to say they will scale back in these areas.

Looking Back on 2025

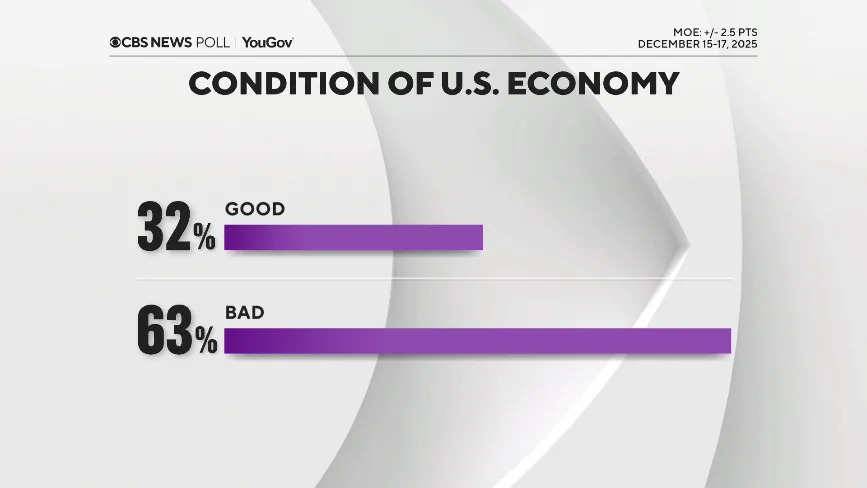

Public views of the economy remained low in 2025. Beneath that broad sentiment there is a clear split: people who say their financial situation is good generally have higher incomes and are more likely to say the stock market matters for them, while those who say their situation is bad are more likely to be lower-income and more affected by prices and inflation.

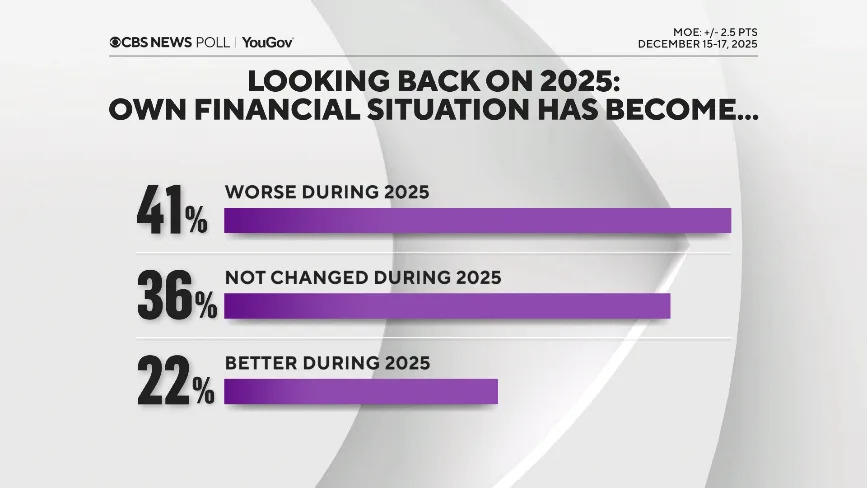

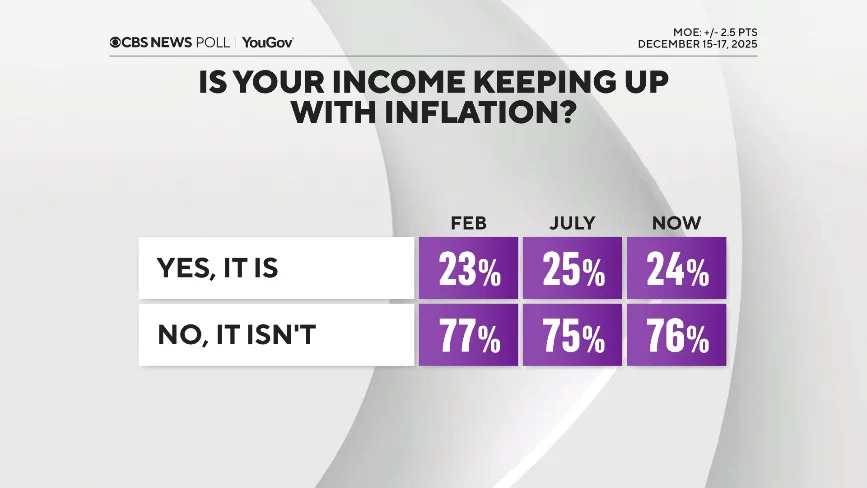

Across 2025, about three-quarters of adults said their incomes were not keeping pace with inflation. On personal finances, roughly half of U.S. adults continue to describe their situation as good and half as bad. Among people whose finances changed during the year, more reported that their situation worsened than improved; those who improved were disproportionately higher-income.

Labor Market And Markets

Perceptions of the U.S. job market remain net negative, despite recent government data showing a mixed picture: employers added more jobs in November than economists expected, while the unemployment rate rose to its highest level since September 2021. On balance, more Americans rate the stock market's condition as good rather than bad — particularly among those who say market performance matters to their finances.

Methodology

This CBS News/YouGov poll surveyed a nationally representative sample of 2,267 U.S. adults interviewed between December 15–17, 2025. The sample was weighted by gender, age, race and education using the U.S. Census American Community Survey and Current Population Survey, and by 2024 presidential vote. The margin of error is ±2.5 percentage points.