Venezuela holds the world’s largest proven oil reserves (≈303 billion barrels, 2023), concentrated in the extra‑heavy Orinoco Belt, and significant gas reserves (≈5.5 trillion m³). Production fell for years before rising to about 952,000 bpd in 2024 amid persistent political and institutional problems. The country also reports official gold reserves (~161.2 tonnes) and large, but largely unexploited, deposits of coal, iron, nickel, bauxite and diamonds. Development is constrained by underinvestment, sanctions and security challenges.

Beyond Oil: Venezuela’s Vast Energy and Mineral Wealth, and Why It’s Hard To Tap

Following reports last week of an alleged abduction of President Nicolás Maduro, U.S. officials said they want to restore Venezuela’s oil production and expand mining activity. This article summarizes the country’s main natural resources, what makes them valuable, and the political, technical and security challenges that limit development.

Overview

Venezuela is best known for its oil, but it also holds major gas, gold and a wide range of other mineral deposits. Many estimates are dated or contingent on difficult extraction conditions, and development has been constrained by political instability, underinvestment and security problems.

Oil: Reserves, Quality and Production

Proven Reserves: Venezuela has the world’s largest proven oil reserves, estimated at 303 billion barrels (2023). The country was a founding member of OPEC in 1960.

Orinoco Belt: Most reserves lie in the Orinoco Belt in the east, a region of roughly 55,000 km² (21,235 sq mi). The crude is largely extra-heavy and very viscous, which raises extraction and upgrading costs and typically leads to a price discount versus lighter crudes.

Refining: Processing Orinoco crude requires upgrading and specialized refining capacity; much of the world’s facilities capable of handling extra-heavy grades are located in U.S. Gulf Coast refining hubs such as Texas and Louisiana.

Production Trends: Long a major oil exporter, Venezuela’s output collapsed after years of mismanagement, underinvestment and sanctions. According to PDVSA results reported by OPEC, average production rose to 952,000 barrels per day (bpd) in 2024, up from 783,000 bpd in 2023. Reuters reported PDVSA’s international oil sales in 2024 at about $17.52 billion.

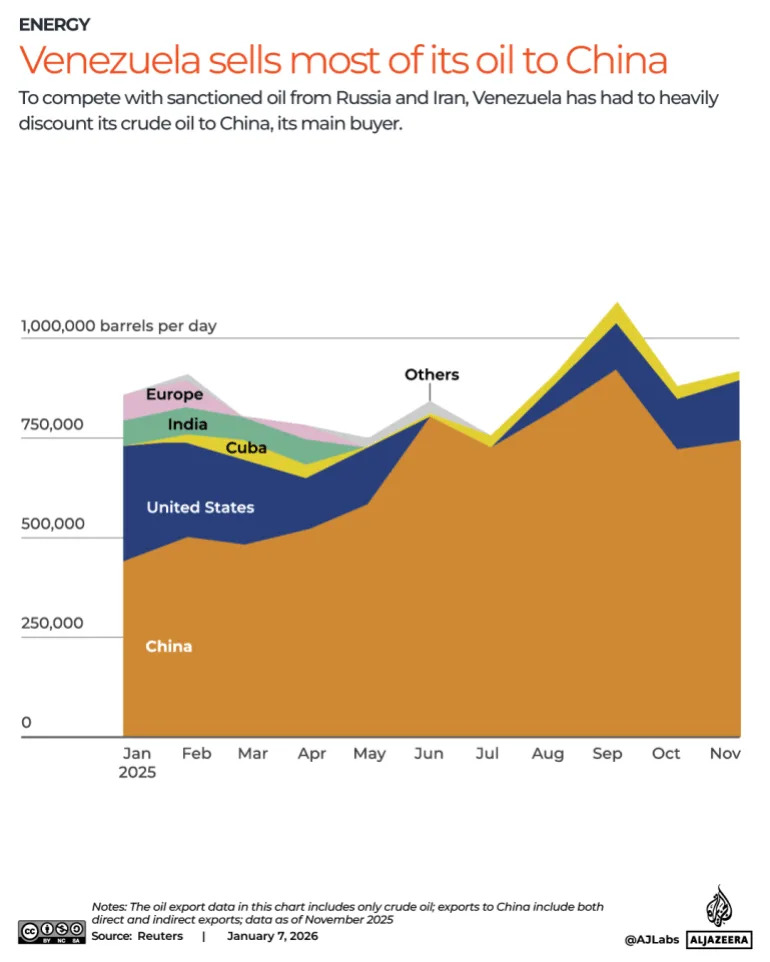

Exports and Major Buyers

China has been Venezuela’s largest crude buyer for the last decade. Reports indicate that in November 2025 — prior to a reported U.S. military blockade that began in December — Venezuela exported roughly 952,000 bpd, of which about 778,000 bpd (≈81.7%) went to China. The United States and Cuba were reported as smaller buyers, at approximately 15.8% and 2.5% of exports respectively. These figures are based on reported export tallies and may change with new trade dynamics.

Natural Gas

Venezuela ranks among the top countries globally for natural gas reserves, placed ninth worldwide by some assessments. The International Energy Agency estimated around 5.5 trillion cubic metres (195 trillion cubic feet) of gas reserves as of 2023, representing about 73% of South America’s total. Most volumes are associated gas — byproducts of oil production — and roughly 80% of domestic gas output is produced alongside crude.

Gold and Other Minerals

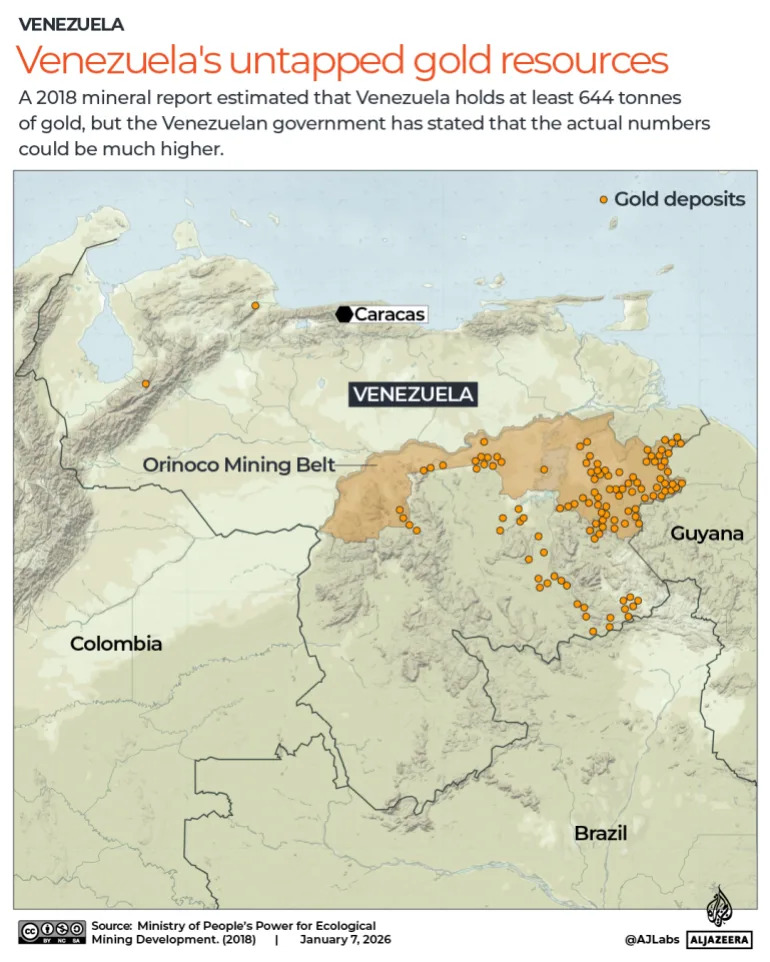

Gold Reserves: Official central-bank gold holdings are reported at about 161.2 metric tonnes (World Gold Council), with a market value in the tens of billions of dollars depending on the gold price. Independent and government estimates suggest significantly larger untapped deposits, but data are dated and difficult to verify.

Orinoco Mining Arc & Plans: The Orinoco Mining Arc was announced in 2011 to expand mineral development; in 2016 the government earmarked roughly 12% of national territory for mining. A 2018 government minerals catalogue provided large estimates for other resources, though many figures remain provisional and extraction has been limited.

Selected 2018 Estimates (Provisional): certified coal ~3 billion tonnes; iron ore ~14.68 billion tonnes (≈3.6 billion proven); nickel ~407,885 tonnes; bauxite ~99.4 million tonnes; diamonds ~1,020 million carats across the Orinoco Arc and an additional 275 million carats in Guaniamo. Treat these numbers as indicative rather than definitive.

Challenges And Outlook

Venezuela’s resource potential is large, but unlocking it faces multiple obstacles: weak institutional capacity, underinvestment in infrastructure, U.S. and other sanctions, environmental concerns, and the presence of non-state armed groups that control many informal mining areas. Any revival of production or mining at scale will require sustained investment, stronger governance, and improved security.

Bottom Line: Venezuela’s resource base extends far beyond oil — to vast gas deposits, significant official gold reserves and large estimated deposits of coal, iron, nickel, bauxite and diamonds — but turning those resources into stable economic gains remains a complex political and technical challenge.

Help us improve.