Quick Take: Vice President J.D. Vance and President Trump have celebrated the economy, but recent BLS data point to slowing job growth and rising broader underutilization. A 100,000-job October decline was concentrated in federal employment after a shutdown, and 92% of jobs added since January have been in education and health care. The U-6 underemployment rate has climbed to 8.7%, and hiring slowed sharply after April.

Trump and Vance Call the Economy A++ — New Labor Data Tells a Different Story

Vice President J.D. Vance praised President Donald Trump’s economic stewardship at an affordability event in Pennsylvania, echoing the president’s claim that the economy deserves an “A-plus-plus-plus-plus-plus.” But fresh Bureau of Labor Statistics data released the same day show signs of slowing labor-market momentum that complicate that upbeat narrative.

What the Latest Numbers Show

The BLS reported that the headline unemployment rate rose to a four-year high in November. October’s payrolls also showed a rough 100,000-job drop — a decline concentrated largely in federal employment after an extended government shutdown affected payrolls in both October and November.

Where New Jobs Actually Came From

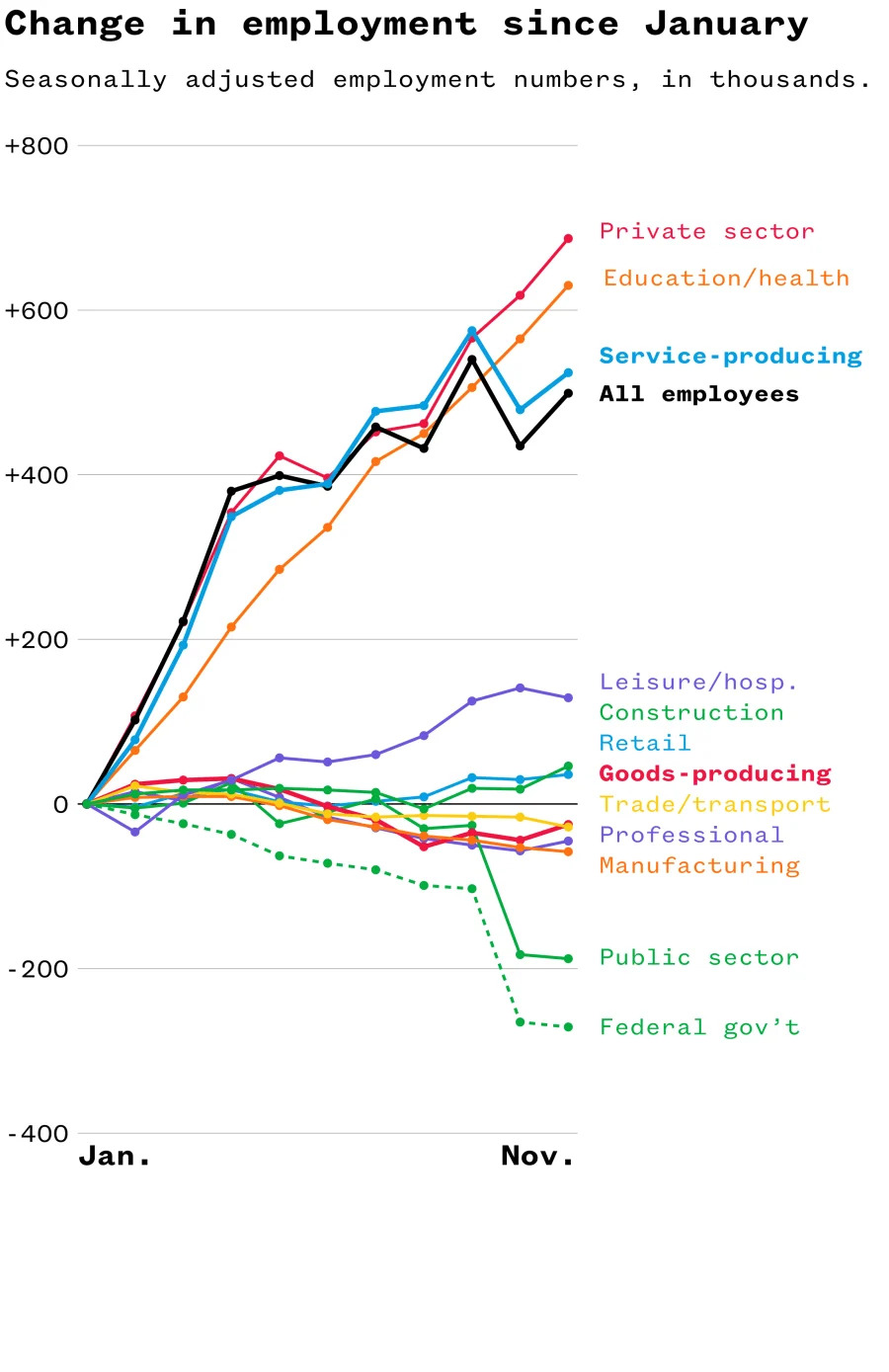

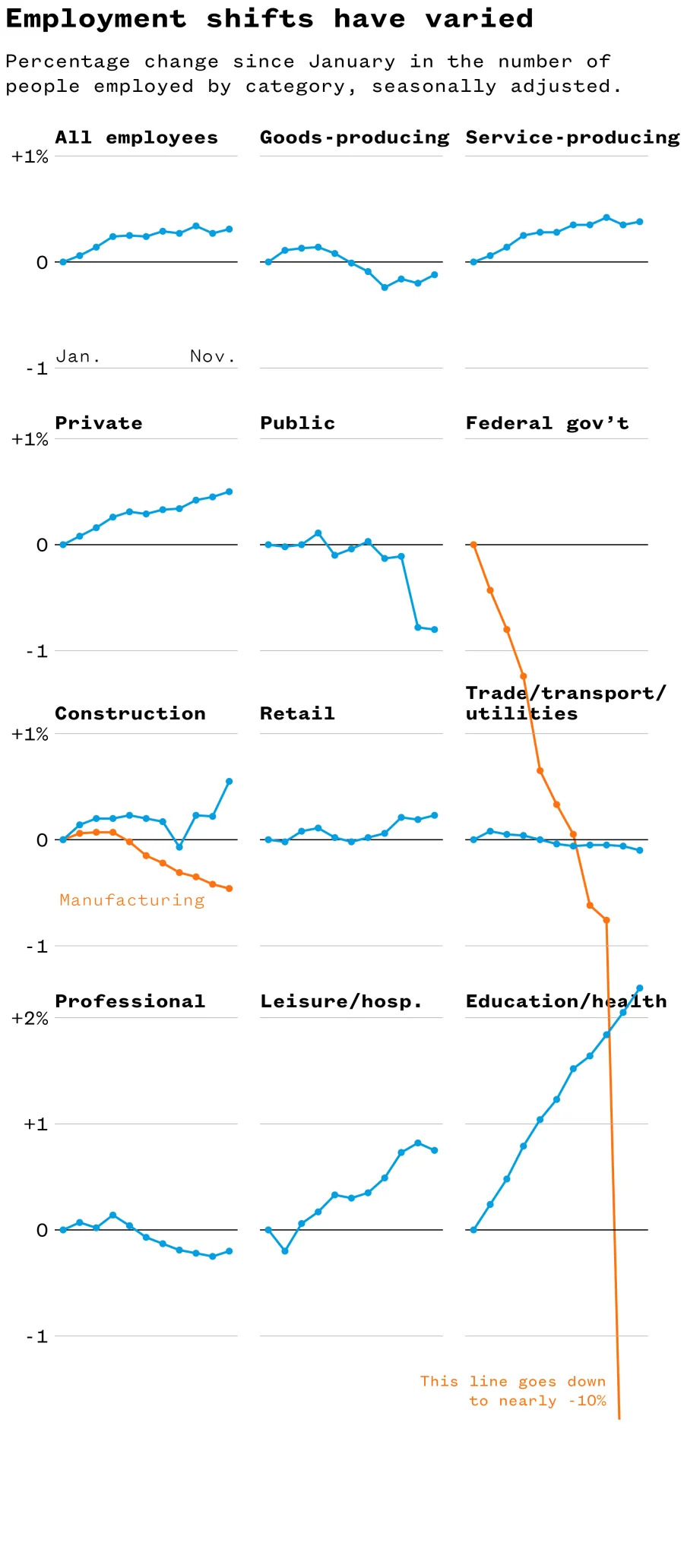

Since January, total employment in the U.S. has inched higher, but the gains are overwhelmingly concentrated in the service sector. Education and health care alone account for roughly 92 of every 100 jobs added this year, while manufacturing and some professional sectors have seen modest gains or outright declines.

Private Sector Gains Haven't Fully Offset Federal Losses

Vance emphasized that the October decline was driven by government-sector job losses and framed that as part of the administration’s aim to reduce federal payrolls. While the composition point is largely correct, private-sector hiring has been too sluggish to fully offset the drop in government employment — especially since hiring slowed substantially after April.

Vance: “When you talk about 100,000 jobs, you’re talking about government sector jobs… We want to fire bureaucrats and hire these great Americans out here.”

Signs of Slowing Momentum

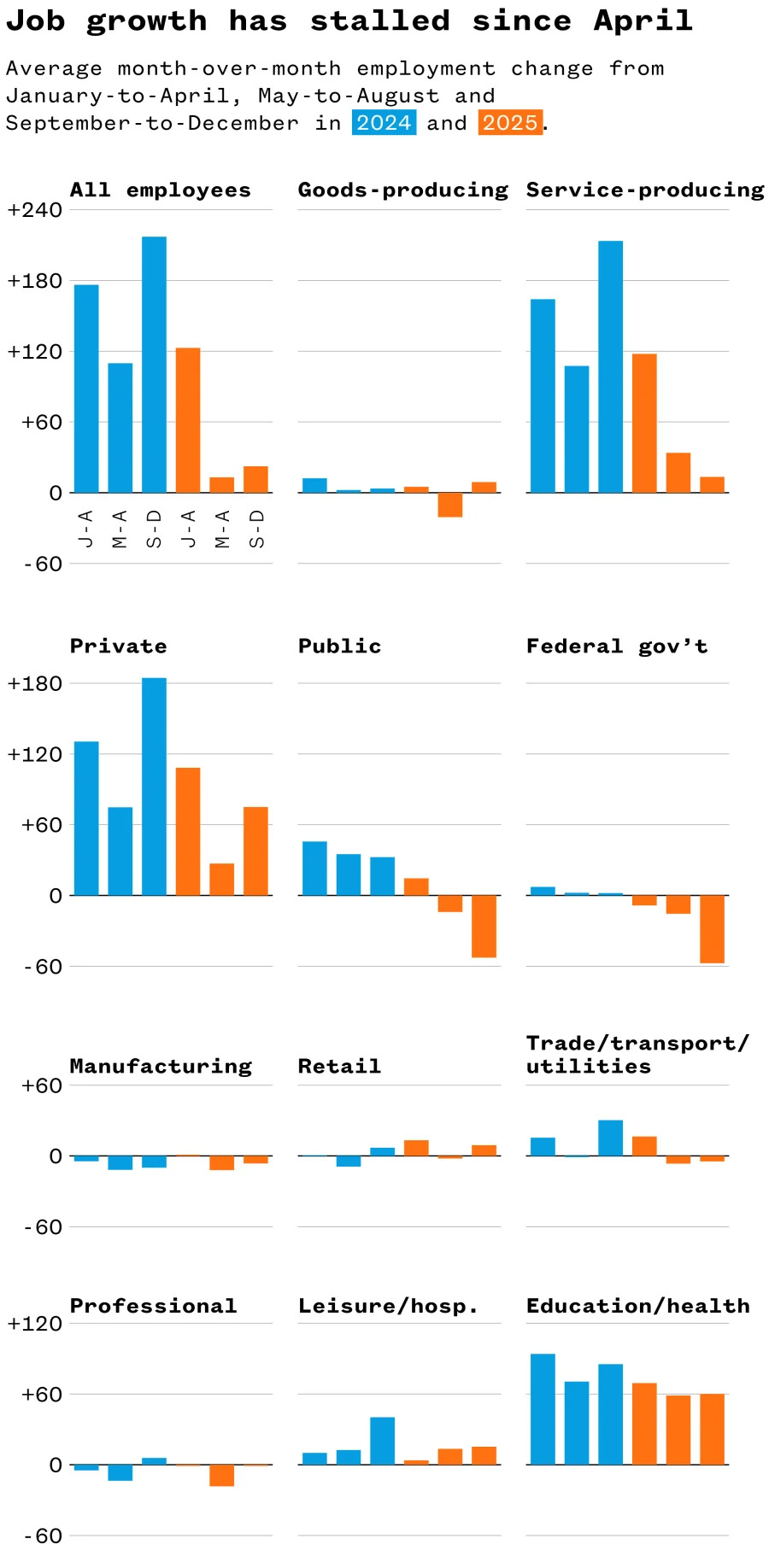

Average monthly job gains from January to April were roughly 123,000, down from the 2024 monthly average of about 168,000. From May through August, monthly gains fell dramatically to about 13,000 on average; over the most recent two-month stretch the average was roughly 23,000. This slowdown comes even as the U.S. population grew by more than three million people during the same period.

Broader Measures of Labor Underutilization

The BLS’s broader U-6 measure — which includes unemployed workers, people working part time for economic reasons, and marginally attached workers — stands at about 8.7%, its highest level since August 2021. Under that metric, roughly 15 million Americans are counted as underutilized in the labor market.

Policy Factors: Tariffs and The Shutdown

Economic policy choices appear relevant. Tariffs rolled out in April are expected to extract hundreds of billions of dollars from consumers and businesses by year’s end, a burden cited by many analysts as a principal drag on growth. The extended government shutdown also depressed federal payrolls, contributing directly to the recent monthly declines.

Bottom Line

While the headline number of employed Americans has risen since January, that growth is narrowly concentrated and the pace of hiring has slowed markedly. The administration’s A++ characterization of the economy does not square with broader measures of underemployment, sectoral weakness outside education and health care, or the recent turn in job-creation momentum.