Documents from the U.S. Justice Department show UBS began banking Ghislaine Maxwell in 2014 and managed up to $19 million in assets before her 2021 conviction for sex trafficking. The files detail account openings, assigned relationship managers, large transfers and the bank's cooperation with a grand jury subpoena in August 2019. While UBS briefly issued a credit card to Jeffrey Epstein in 2014, that account was closed the same year. The records do not allege illegal conduct by UBS or its advisers.

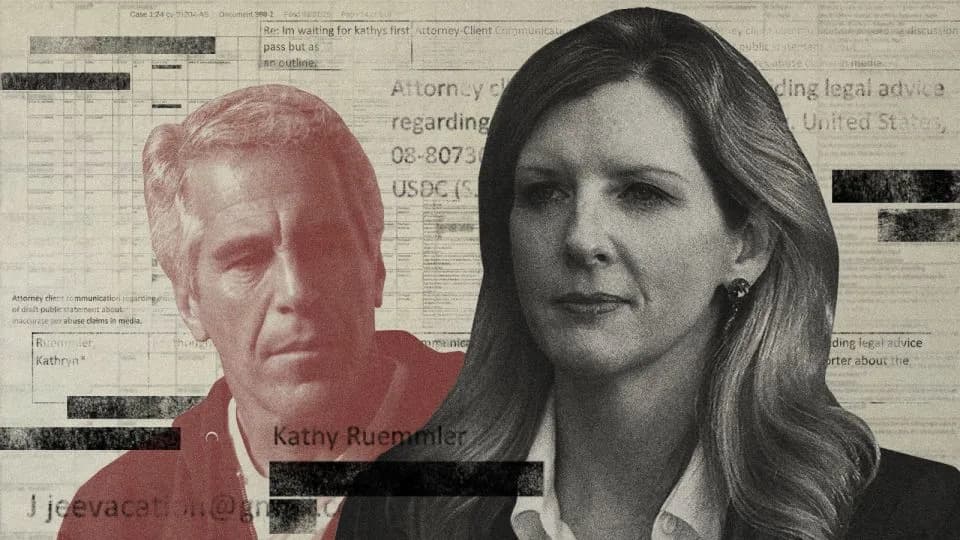

UBS Took Ghislaine Maxwell As A Client In 2014, Managed Up To $19M — Documents Reveal

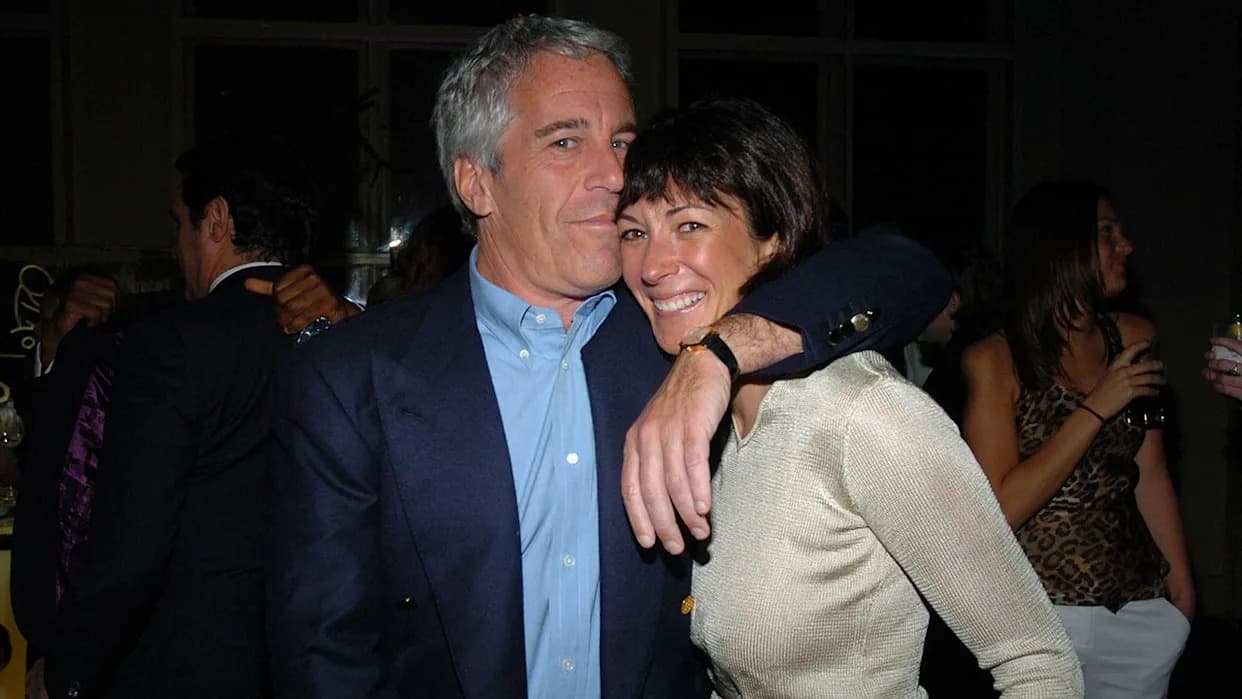

Documents released by the U.S. Justice Department show that Swiss wealth manager UBS opened personal and business accounts for Ghislaine Maxwell in 2014 and managed as much as $19 million in the years before her conviction for sex trafficking. The records — including emails, bank statements and internal notes — provide a clearer timeline of the bank’s relationship with Maxwell and its interactions after Jeffrey Epstein’s 2019 arrest.

Accounts, Services and Transfers

UBS opened accounts for Maxwell that held cash, equity and hedge-fund investments and assigned two relationship managers to her. According to the files, those managers facilitated sizable transfers and provided services commonly offered to high-net-worth clients. The accounts were used for Maxwell’s personal expenses and for entities tied to her activities, including the TerraMar Project and companies named Ellmax, Pot & Kettle, Max Foundation and Max Hotel Services.

Connections With Epstein And JPMorgan Background

Epstein and Maxwell had previously banked with JPMorgan, which in internal checks flagged Maxwell as a "High Risk Client" because of her connection to Epstein. JPMorgan closed Epstein’s account in 2013; the bank later settled litigation related to Epstein for $75 million in 2023. The UBS records show that, after JPMorgan cut ties, Maxwell was introduced to UBS in late 2013 and moved accounts to the Swiss bank in early 2014.

Epstein Credit Card And Account Closures

An email in the disclosed cache indicates UBS briefly provided a credit card to Epstein in 2014 after JPMorgan had closed his accounts; that UBS account was closed in September 2014, with Epstein’s accountant citing "reputational risk." Despite media reporting about Maxwell’s proximity to Epstein, UBS continued its relationship with Maxwell for years afterward.

Regulatory Requests And Cooperation

The files show UBS received a grand jury subpoena for Maxwell on August 16, 2019, and provided information to the FBI about wire transfers and account activity. The documents do not, however, demonstrate any illegal conduct by UBS or its advisers. Some records indicate the bank conducted due diligence before transferring accounts from JPMorgan, but Reuters could not obtain full details of that process.

Legal Status And Open Questions

Ghislaine Maxwell was arrested in 2020, convicted in 2021 of facilitating Jeffrey Epstein’s sexual abuse of minors, and is serving a 20-year sentence. The disclosed records do not make clear when—or whether—UBS ultimately closed all of Maxwell’s accounts. UBS declined to answer questions about why it accepted a client another bank had flagged as high risk; Maxwell’s lawyer did not respond to requests for comment.

Summary of Key Facts: UBS opened accounts for Maxwell in 2014, managed substantial assets and transferred funds after Epstein’s arrest; it also responded to a grand jury subpoena in 2019. The released documents contain no evidence that UBS or its advisers committed wrongdoing.

Help us improve.