The US operation that removed Nicolás Maduro on January 3 has produced an evolving, coercion‑based US approach to Venezuela that blends military pressure, sanctions and oil leverage. Washington has begun selling stranded Venezuelan crude and courting foreign oil investment, while Caracas — led by acting president Delcy Rodriguez — has adopted a cautious, sometimes conciliatory posture. Analysts warn that visible calm masks deep fault lines in the military and political elite and that opaque financial arrangements and coercive tactics could undermine long‑term stability and investment prospects.

Remote Coercion: How the US Has Acted Since Maduro’s Abduction

What opened the year was extraordinary: a lethal US military operation on Venezuelan soil on January 3 that resulted in the removal and detention of long-time leader Nicolás Maduro. Three weeks on, Washington has not presented a fully formed Venezuela strategy; instead, analysts say, a loose, evolving framework built around military pressure, sanctions and oil leverage has emerged.

Current US Posture

Maduro has been held in a New York prison since the operation and is awaiting trial on drug‑trafficking and conspiracy charges that US prosecutors have described as involving "narcoterrorism." Large elements of the US military remain deployed off Venezuela’s coast, and a de facto blockade affecting sanctioned oil tankers continues. The administration has pledged further strikes against alleged drug‑smuggling vessels in the Caribbean and has not ruled out future ground operations.

"What we’re seeing is not a fully formed [US] strategy, but an evolving one," said Francesca Emanuele, senior international policy associate at the Center for Economic and Policy Research.

Oil, Finance And Access

US officials have made clear that access to Venezuela’s oil is central to their calculations. Days after Maduro’s removal, Washington and Caracas announced arrangements to export up to $2 billion of crude that had been stranded at Venezuelan ports by US measures. The first sale — roughly $500 million — was announced last week; Delcy Rodriguez said Caracas received about $300 million and would use the funds to stabilise the foreign‑exchange market.

Analysts and lawmakers have raised questions about the transparency of how those proceeds are being handled. Phil Gunson, senior analyst at the International Crisis Group, warned that the scheme for acquiring and selling Venezuelan crude remains opaque and that Venezuela’s history of corruption and patronage amplifies concerns about oversight and distribution.

Push For Foreign Investment

The White House has actively courted US oil firms. Six days after the operation, President Trump hosted executives from 17 energy companies and spoke of potential investment of "at least $100 billion". Industry leaders nonetheless stressed that major reforms would be necessary before Venezuela became an attractive, investable market. The administration has offered security guarantees for foreign companies — reportedly including private security contractors — but many details remain unsettled.

Begum Zorlu, a research fellow at City, University of London, described the approach as a "control mechanism" that relies on fear: sanctions, oil leverage and the threat of renewed force. "What emerges is not governance but a strategy of remote coercion, forcing the post‑Maduro leadership to comply with US demands, particularly around oil access," she said.

Political Dynamics In Caracas

On the streets of Caracas the mood is best described as "tense but calm." There is a visible security presence, including colectivos — pro‑government paramilitary groups — and elite military counter‑intelligence units such as the DGCIM. For now, neither mass protests nor public celebrations have materialised; many citizens and observers are in a "wait‑and‑see" frame of mind.

Public statements from the regime’s three power centres have been notably muted: the civilian wing around acting president Delcy Rodriguez and her brother Jorge Jesús Rodriguez; the military under Defence Minister Padrino López; and Interior Minister Diosdado Cabello, who controls police and much of the intelligence and retains influence over colectivos.

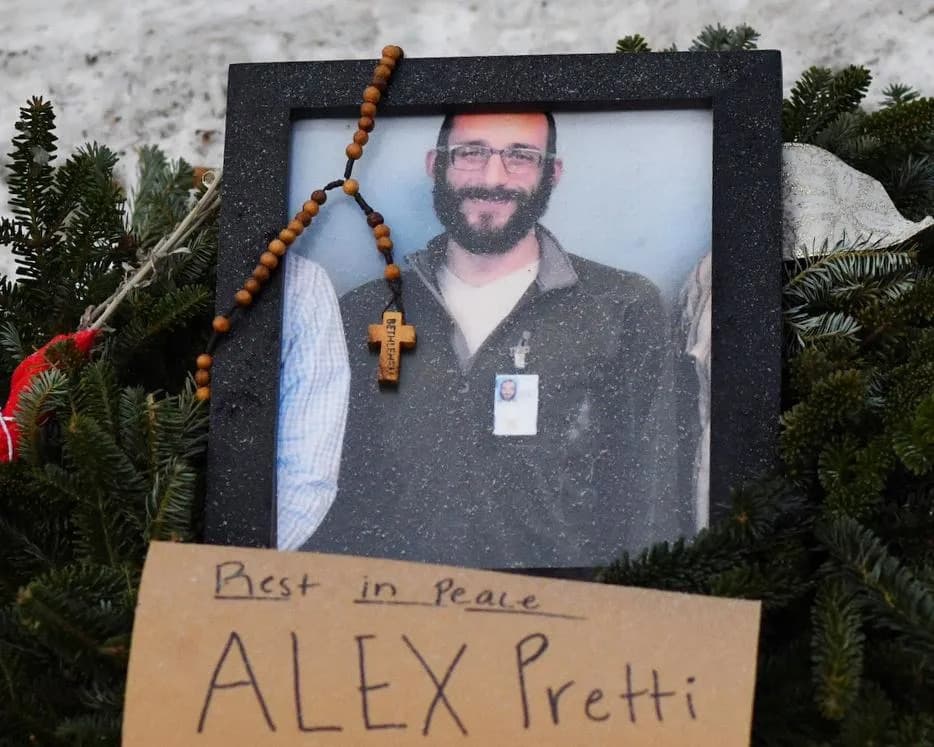

Rodriguez has shifted from an early, largely performative defiance to a more conciliatory tone toward Washington. Her government has reshuffled some ministers — including the removal of Alex Saab, a longtime Maduro ally and US target, from the industry portfolio — and signalled openness to foreign investment in the oil sector. Officials have also begun releasing some political prisoners detained after the contested 2024 election claims.

Tensions, Fractures And Uncertainties

Analysts warn that outward compliance should not be mistaken for stability. Venezuela’s governance has long relied on patronage networks and fragile alliances. Gunson cautioned that the Rodriguez siblings "could be ousted at any point if factions with the guns chose to do so." Both Defence Minister Padrino and Diosdado Cabello — like Maduro — remain the subject of US indictments and rewards for information, adding another layer of risk for regime actors contemplating accommodation.

There are also persistent reports that some elements within Maduro’s inner circle were contacted by US officials before the operation. The Guardian reported sources saying Delcy Rodriguez had previously assured US officials she would cooperate in the event of Maduro’s removal, while Reuters reported prior contacts between US officials and Cabello; in both cases, the depth and purpose of those contacts remain unclear.

What Comes Next

Multiple outcomes remain possible. The US appears to be pursuing a strategy that mixes coercion and negotiated openings: selling stranded oil, courting investors, and offering protection for commercial activity while keeping military pressure as leverage. That approach may yield short‑term access to resources but — as Zorlu warns — could undermine the political stability and investment climate needed to exploit Venezuela’s oil at scale.

"The coming months are likely to reveal fractures that are not yet visible," she said. Observers will be watching closely for signs of defections within the security forces, shifts in the coordination among civilian leaders, and how transparently oil revenues and investment deals are handled.

Help us improve.