South Korea has sought U.S. approval to build nuclear-powered attack submarines, and President Trump publicly signalled support. Seoul says SSNs would improve tracking of North Korean and Chinese submarines and reduce the burden on U.S. forces, while creating industrial jobs. Major hurdles include a decades-old U.S.-South Korea nuclear agreement, questions over technology transfer and construction location, lengthy technical and congressional reviews, and potential regional backlash from North Korea and China.

South Korea Seeks U.S. Approval for Nuclear-Powered Attack Submarines — Strategic and Industrial Stakes

South Korea has publicly pressed to build nuclear-powered attack submarines (SSNs), and won public backing from U.S. President Donald Trump. If approved, Seoul would join an exclusive group of SSN operators — the United States, Russia, China, France, the United Kingdom and India — with implications for regional security, alliance burden-sharing and domestic industry.

Why Seoul Wants SSNs

Seoul argues that SSNs would strengthen its ability to monitor and counter North Korean and Chinese undersea activity around the Korean Peninsula while easing pressure on the U.S. submarine fleet to cover other Indo-Pacific hotspots. South Korean officials also point to potential economic benefits: designing and building SSNs could create thousands of high-paying manufacturing jobs and deepen integration across allied shipbuilding supply chains.

Operational Advantages and Domestic Capability

Nuclear-powered submarines can remain submerged far longer than diesel-electric boats, are typically faster, and in many cases operate more quietly. South Korea already fields advanced conventional submarines — notably the 3,600-ton Jang Yeongsil, built by Hanwha Ocean and fitted with lithium-ion batteries that substantially extend submerged endurance.

Defense officials and retired submarine officers maintain Seoul has the industrial base and shipbuilding expertise to build large submarines. Some Jangbogo-III-class designs were reportedly conceived with future nuclear propulsion in mind, but senior naval officers warn conversion or new SSN development could still take a decade or more.

Legal, Industrial and Logistical Hurdles

A major legal obstacle is a decades-old bilateral nuclear agreement that restricts South Korea from reprocessing spent nuclear fuel — a provision Seoul has sought to revise. The scope of U.S. permission remains unclear: will Washington only supply nuclear fuel, or also allow transfer of propulsion technology?

Location and technology transfer are central political issues. President Trump publicly mentioned the Philadelphia Shipyard — recently acquired in part by South Korea’s Hanwha — as a potential construction site, while Seoul has emphasized domestic production to preserve know-how and industrial benefits. Building SSNs requires specialized covered assembly facilities, dry docks and access to naval nuclear reactors; the Philadelphia yard is being modernized but is mainly configured for commercial shipbuilding, so it may only assemble modules with nuclear plants completed in the United States.

U.S. submarine production is concentrated at two busy yards (General Dynamics Electric Boat and Huntington Ingalls’ Newport News), complicating any plan that depends on U.S. industrial capacity. In addition, the U.S. Department of Defense technical review and Congressional approval would likely take time.

Timeline and Practical Outlook

Analysts and South Korean officials broadly estimate at least 10 years before an operational SSN could enter service, even with swift diplomatic and industrial cooperation. Work would include legal renegotiation, technology-transfer agreements, construction of specialized facilities, workforce training and reactor integration.

Regional Reactions and Risks

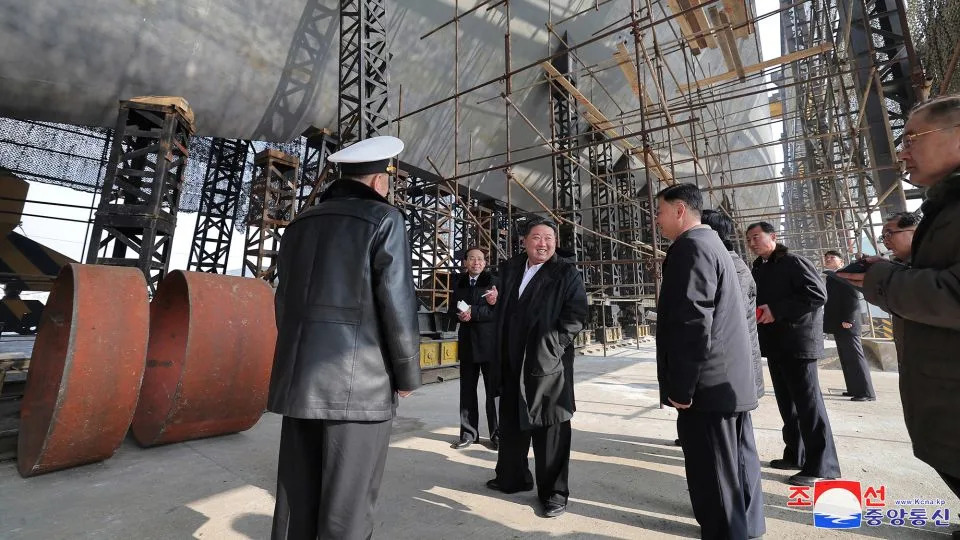

North Korea condemned Seoul’s pursuit as a step toward "nuclear weaponization," despite South Korea’s assurances that the submarines would not carry nuclear weapons. Pyongyang claims its own nuclear-powered submarine program aims for completion under its weapons-development plans. China urged restraint and reminded both countries of nuclear non-proliferation obligations, while commentators warn the move could inflame regional tensions and risk economic or diplomatic backlash against Seoul.

Bottom line: South Korea’s SSN proposal promises strategic and industrial gains but is bound up with complex legal, technical and geopolitical trade-offs. Even with U.S. support, the program would be lengthy, costly and politically sensitive.