Chicago homeowners in Lawndale staged a "property tax bonfire" to protest rising bills that residents say have not translated into neighborhood improvements. Attendees questioned TIF-related charges after one homeowner reported a $977 increase over last year. The debate comes as Mayor Brandon Johnson proposes reallocating $1 billion from TIF districts to help balance a $16 billion 2026 budget, drawing concern that local projects could be delayed. Officials note payment plans of up to 13 months are available for homeowners.

Chicago Lawndale Homeowners Hold 'Property Tax Bonfire' — Demand Answers Over Rising Bills and TIFs

Residents in Lawndale Protest Rising Property Taxes, Seek Transparency on Where Money Goes

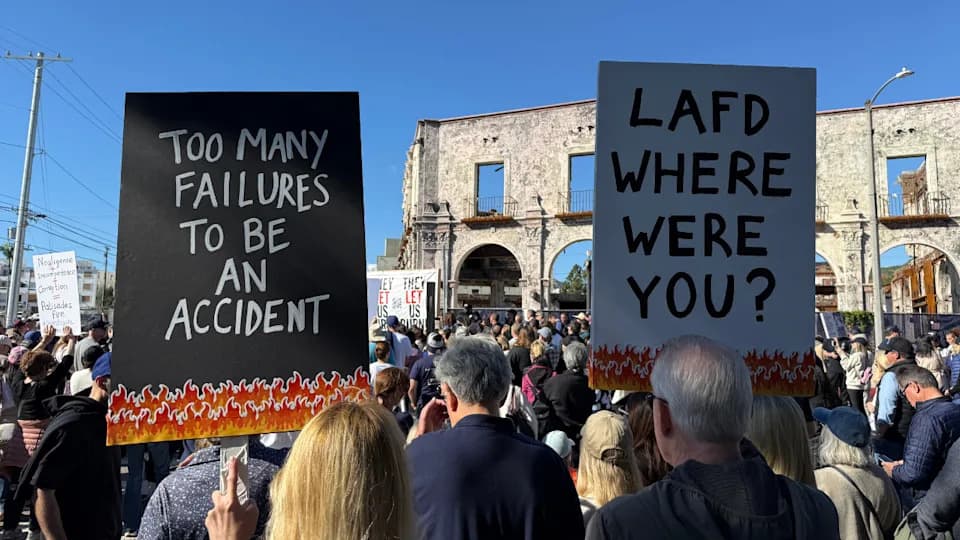

Chicago homeowners in the Lawndale neighborhood on the city's West Side gathered at a local church to voice frustration over rising property tax bills that many say have not produced visible neighborhood improvements. Community leaders and the Lawndale Christian Development Corporation organized the event, described by attendees as a "property tax bonfire."

“There has been a divestment in this community for the most part, but now that people are trying to reclaim the neighborhood it feels like we're being taxed for prosperity,”— Milton Clayton, Lawndale resident.

Several homeowners described steep increases. Thomas Worthy said a mid-November bill was $977 higher than the previous year and questioned a charge tied to a tax increment financing district.

What is a TIF and why residents are concerned

Tax increment financing (TIF) is a mechanism that uses the increase in property tax revenue within a designated area to fund local redevelopment and infrastructure projects, according to the City of Chicago. Residents at the event expressed confusion about TIF charges appearing on their bills and whether those funds are benefiting their neighborhood.

Worthy and others argued the core issue is property valuations and distribution of funds: “We don't have the schools we need. It's economics that are not here, but we're being charged to pay for economics in other people’s communities.”

Citywide context and policy debate

A report from the Illinois Policy Institute found that more than half of a typical Chicago homeowner's property tax bill goes to Chicago Public Schools and noted that Illinoisans pay roughly 2.07% of a property's value in property taxes annually—about double the national average. Cook County ranked among the nation's most expensive counties for property taxes in 2022, per the report.

Mayor Brandon Johnson has proposed redirecting a record $1 billion from TIF districts to help balance a proposed $16 billion 2026 city budget. The plan would draw from 68 of the city's 108 TIF districts, including many on the South and West Sides, prompting aldermen and community leaders to warn it could delay long-promised neighborhood improvements. Supporters argue the reallocation would shore up city finances and boost school funding.

Relief options for homeowners

Cook County Treasurer Maria Pappas told residents at a Chicago Rainbow PUSH Coalition event that homeowners can access property tax payment plans of up to 13 months. “You do not have to pay your bill on Dec. 15,” she said, urging residents to explore available payment options.

The Lawndale protest highlights broader questions about transparency, valuation, and how municipal funding tools such as TIFs are used — issues that resonate across Chicago neighborhoods facing rising housing costs.

Help us improve.